The Kenya Revenue Authority (KRA) has issued a notice over the adjustment of Excise Duty for 16 goods and services set to take effect from December 27, 2024.

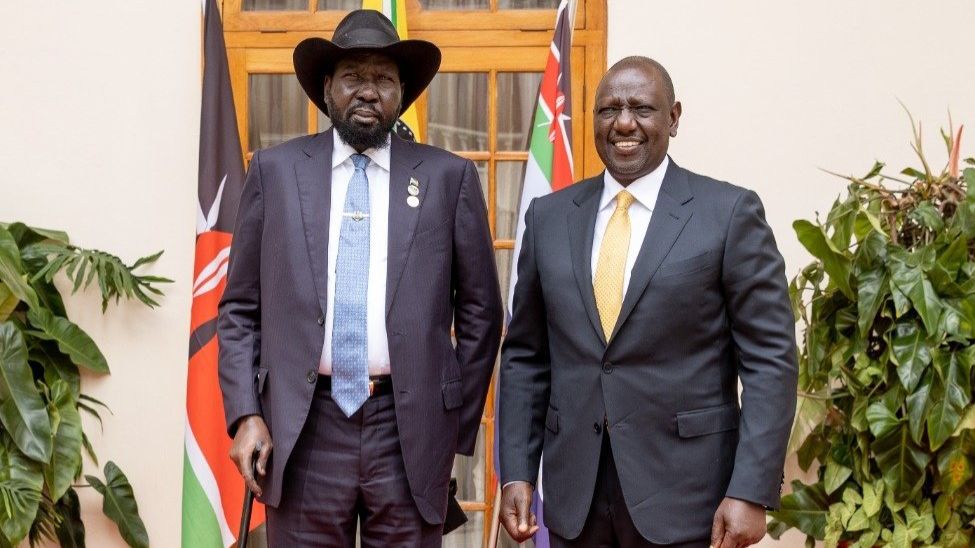

In a notice dated Monday, December 23, the taxman explained that the adjustments were effected following the assent of the Tax Laws (Amendment) Act, 2024 by President William Ruto.

Some of the items facing higher tax rates include imported sugar whose new Excise Duty rate will be Ksh7.50 per kg from the previous rate of Ksh5 per kg.

Cigarettes with filters will attract a new Excise Duty of Ksh4,100 per mille from the current Ksh4,067.03 per mille. On the other hand, the Excise Duty for cigarettes without filters was increased from Ksh2,926.41 per mille to Ksh4,100 per mile.

Read More

Meanwhile, products containing nicotine or nicotine substitutes intended for inhalation without combustion or oral application will attract a new duty rate of Ksh2,000 per kg from the Ksh1,594.50 charged today.

The excise duty of liquid nicotine for electronic cigarettes was increased from Ksh70 per millilitre to Ksh100 per millilitre.

Also set for new Excise Duty rates include wine, beer, cider and spirits.

Therefore, manufacturers, importers, and suppliers of excisable goods and services to take heed of the new rates.

"Imported self-adhesive plates, sheets, film, foil, tape, strip and other flat shapes, of plastics, whether or not in rolls of tariff number but excluding those originating from East African Community Partner States that meet the East African Community Rules of Origin will be charged at 25% to or Kshs 200 per kg, whichever is higher," read the statement in part.

Excise duty for the amount staked for gaming betting, prize competition and lottery ticket prices will increase from 12.5 per cent to 15 per cent.

Manufacturers of the excisable goods and suppliers of the excisable services are required to charge the new excise duty rates on the excisable goods and services with and remit the tax collected to the Commissioner as follows."

"In the case of betting and gaming services, within twenty-four hours from the closure of transactions of the day; in the case of licensed manufacturers of alcoholic beverages, on or before the fifth day of the month following the month in which the tax was collected; and in the case of other licensed persons, on or before the 20th day of the month following the month in which the tax was collected." read the notice in part.