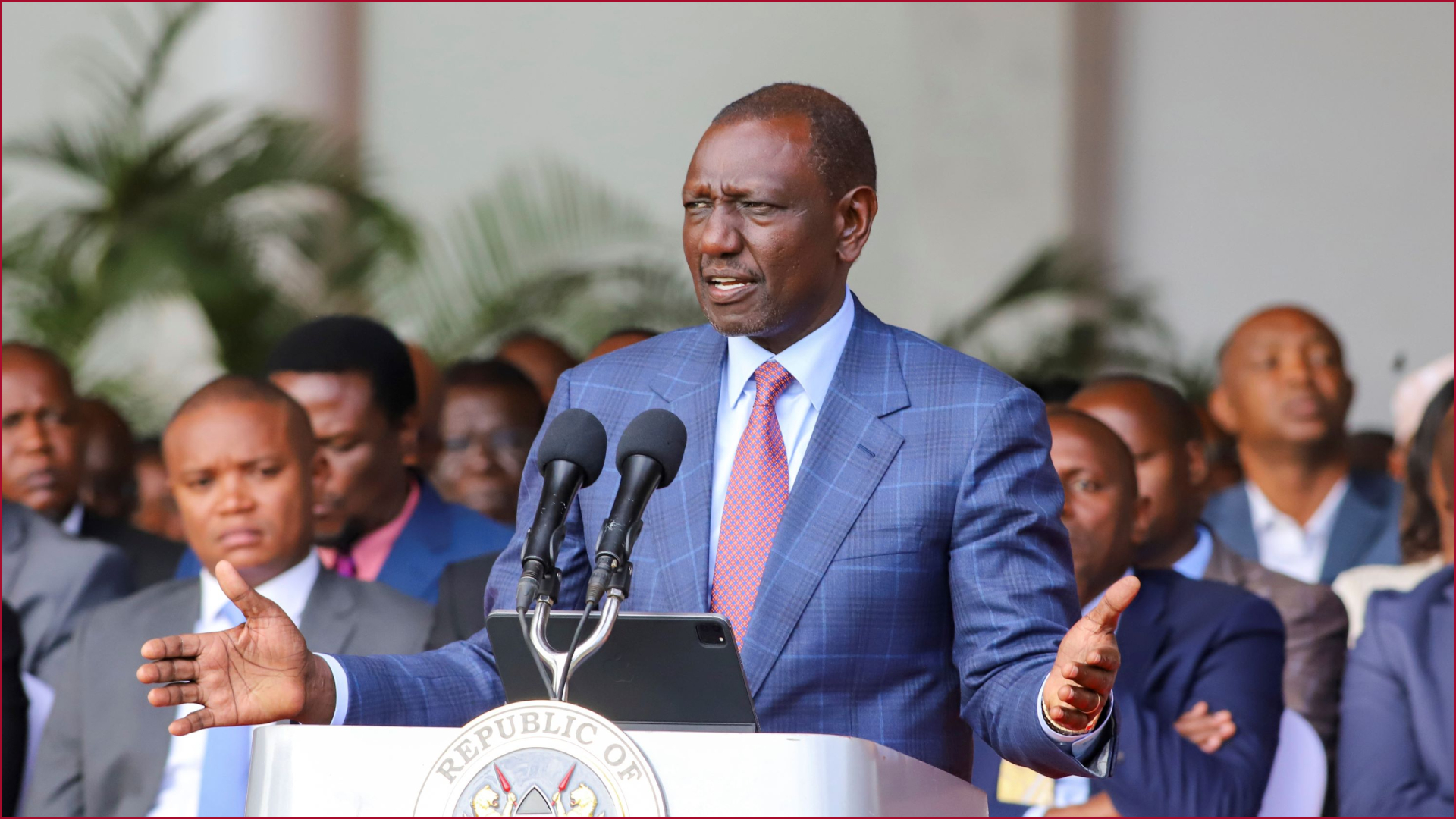

President William Ruto has announced that Kenya has settled part of the 2 billion dollar 2014 Eurobond that was scheduled to mature on June 24, 2024.

Addressing the media on Wednesday, February 21, in Naivasha, Nakuru County, the Head of State noted that Kenya paid 1.5 billion dollars that was raised on 12th February 2024.

“The successful execution of both the buy-back and the new bond issue demonstrates strong investor confidence in Kenya through the international capital markets, and a vote of confidence in the government's overall economic management, particularly our public debt management strategy,” said Ruto.

The President noted that when the Kenya Kwanza administration assumed office in 2022, they committed to bringing the economy back on track by taking necessary measures including outright sacrifices to raise revenues and reducing expenditure.

Ruto also said his administration pursued a turnaround strategy focused on increasing our tax revenues and reducing both spending and the rate of debt accumulation.

Read More

“Throughout this process, we have been guided by the principles and values of equity, fairness, and prudence in public spending without sacrificing priority social and development funding,” the President stated.

Ruto went on to disclose that the government has implemented a combination of strategies to ensure that debt is sustainable at all times.

Further, he pointed out that the commitment to sound debt management strategy, fiscal and general economic management policies, and tightening monetary policy by the Central Bank of Kenya has resulted in the appreciation of the shilling against the US dollar, from KSh 162 to KSh 142.

“This has reduced our overall debt by KShs 722 billion, and also reduced our debt service costs by KShs 195 billion over the next 6 years, saving the country a total of KShs 917 billion,” President Ruto added.

-1708516085.jpeg)

-1683725821.jpg)