The Council of Governors (CoG) has protested the Kenya Revenue Authority’s demand for Value Added Tax (VAT) on counties’ revenue sources and attendant interest and penalties.

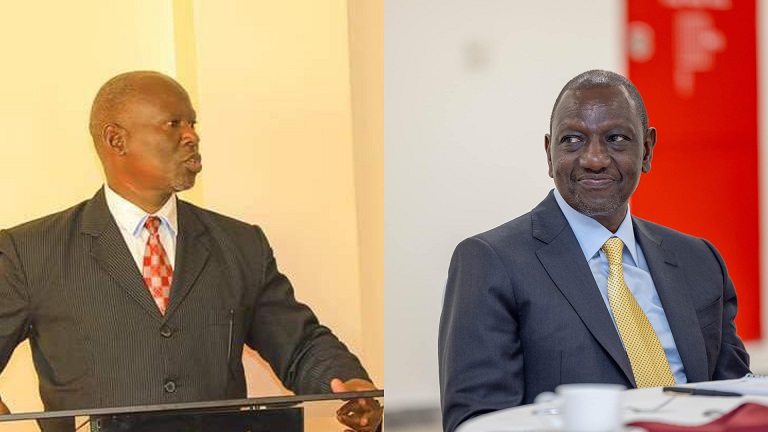

In a statement on Tuesday, June 11, CoG chairperson Anne Waiguru noted that KRA’s demand to counties is unwarranted and undermines the principles of Article 6(2) of the Constitution.

“Article 209 of the Constitution outlines the taxes and charges to be imposed by either level of government. We, therefore, find the demands by KRA on imposition of VAT on Counties' Own Source Revenue (OSR) unconstitutional and an encroachment on the powers to impose taxes and duties of the Counties in contravention to Article 209 (3) and (4) of the Constitution,” read the statement in part.

The Kirinyaga Governor pointed out that the First Schedule of the VAT Act, 2013 exempts services provided by Counties from VAT.

“We therefore maintain that Kenya's constitutional architecture does not envisage that the National Government will impose taxes on revenues raised by the County Governments. It is worth stating that VAT is a consumption tax that is levied on the value added at each stage of a product's production and distribution,” Waiguru asserted.

Read More

The CoG chairperson mentioned that Finance laws enacted by counties do not load the revenue streams and sources with VAT as contemplated by KRA

Further, Waiguru said CoG is open to discussions with KRA discussions geared towards reaching an amicable solution on the issue.

“We, therefore, demand that KRA ceases forthwith from making any such demands for VAT on counties' revenue sources as the same is bereft of any legal backing,” she added.

Waiguru threatened to seek legal redress on the KRA if the authority continued to demand VAT from counties own source revenues.

-1700476031.jpg)