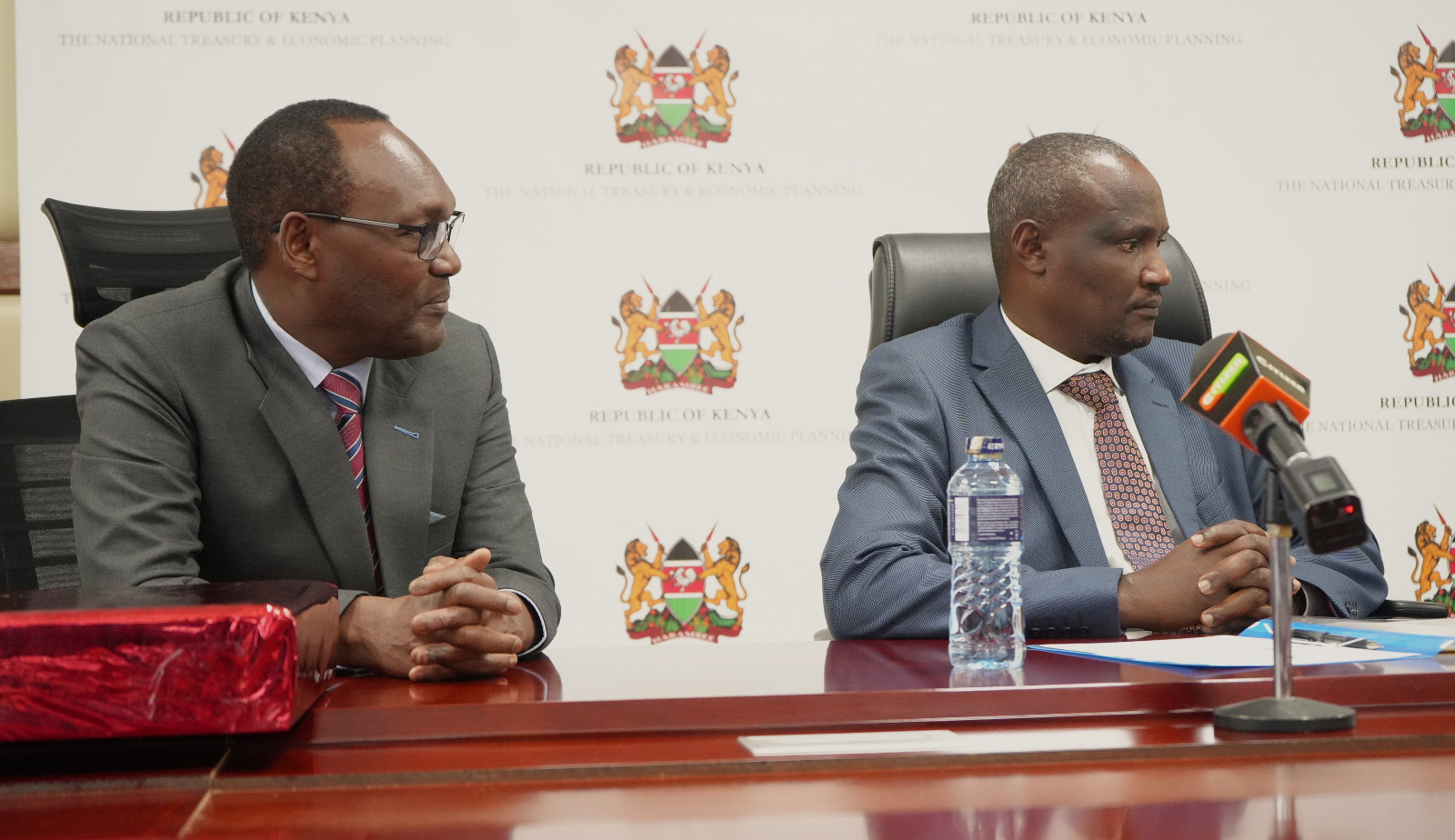

National Treasury Cabinet Secretary John Mbadi has announced that the government plans to reduce taxes over the next three years.

Speaking on Monday, September 9 during the launch of the 2025-2026 Financial Year Budget Preparation Process, Mbadi said the Treasury will reduce Value Added Tax (VAT) from 16 percent to 14 percent.

He also noted that the government will reduce corporate tax from 30% to 25% and Pay-as-you-earn (PAYE).

CS Mbadi emphasized that the National Treasury’s strategy is to reduce taxes and not to increase the tax rates.

“We want to reduce the tax rates, we are not thinking of increasing the tax rate. We are going to reduce VAT in the medium term from 16 percent to 14 percent.

Read More

“We want to reduce other taxes including corporate tax from 30 percent to 25 percent and even Pay as you earn (PAYE). This is the strategy, the thinking of the Treasury is not to increase the tax rates it is to reduce it,” he stated.

CS Mbadi noted that the Treasury has developed a medium-term strategy to enhance domestic revenue mobilization.

The Treasury CS pointed out that the strategy will guide tax administration, improve the administration of tax laws, and create tax rates to enhance compliance.

“We must make sure that KRA collects more. The reforms are already underway. The National Treasury has developed a medium-term revenue strategy to enhance domestic revenue mobilization.

"The strategy will guide tax administration, to improve efficiency in the administration of tax laws, create tax rates that will enhance compliance and build the tax base,” Mbadi remarked.