A document from the National Treasury tabled in the National Assembly indicated that Sh322,178,194,040 in 15 new loans was procured by Kenya between May 1 and August 31 from various commercial and multilateral lenders.

The government borrowed an average of Sh2.62 billion daily within four months in 2020.

Of the 15 new loans, 12 are from multilateral lenders and three from bilateral lenders.

Kenya's public debt drifted to Sh7.12 trillion, about 71.2 per cent of the Gross Domestic Product (GDP) against a ceiling of Sh9 trillion.

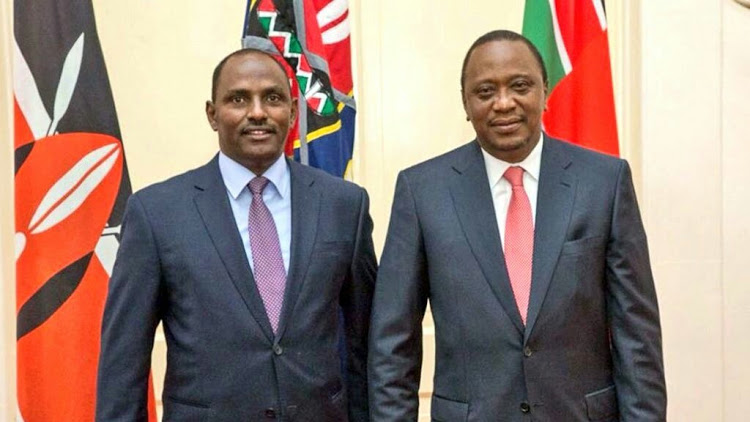

National Treasury Cabinet Secretary Ukur Yatani told the House Committee on Finance and National Planning that the missed revenue collection target brought about by Covid-19 pandemic.

Read More

The National Treasury is set to reinstate old tax rates on PAYE and VAT from January 1.

The government imposed the tax cuts to cushion Kenyans and the economy against the economic effects of the pandemic.

According to Yatani, the monthly Pay-As-You-Earn (Paye) deducted from salaried employees will revert to 30 per cent from 25 per cent in January.

The government is also expected to revert Value Added Tax (VAT) to 16 per cent from current 14 per cent, meaning the prices of fuel, food, drugs and other essential commodities will shoot up.