Four suspects have been arrested as investigations into alleged financial mismanagement at the Kenya Union of Savings & Credit Co-operatives Ltd (KUSCCO) intensify.

In a statement on Thursday, February 13, the National Police Service (NPS) said the Directorate of Criminal Investigations (DCI) apprehended three individuals, namely Jackline Pauline Atieno Omolo, George Ochola Owino, and Mercy Njeru in Nairobi.

According to NPS, the three are facing charges of Conspiracy to Defraud, Stealing by Directors or Officers of Companies, and Making a False Document.

"The three, who were arrested in different areas within Nairobi County, now face several charges including Conspiracy to Defraud Contrary to Section 317 of the Penal Code, Stealing by Directors or Officers of Companies Contrary to Section 282 of the Penal Code, and Making a False document Contrary to Section 347(a) as read with Section 349 of the Penal Code," the statement read.

Read More

Additionally, NPS said an additional suspect in the scandal named George Magutu Mwangi was arrested in Nyeri County.

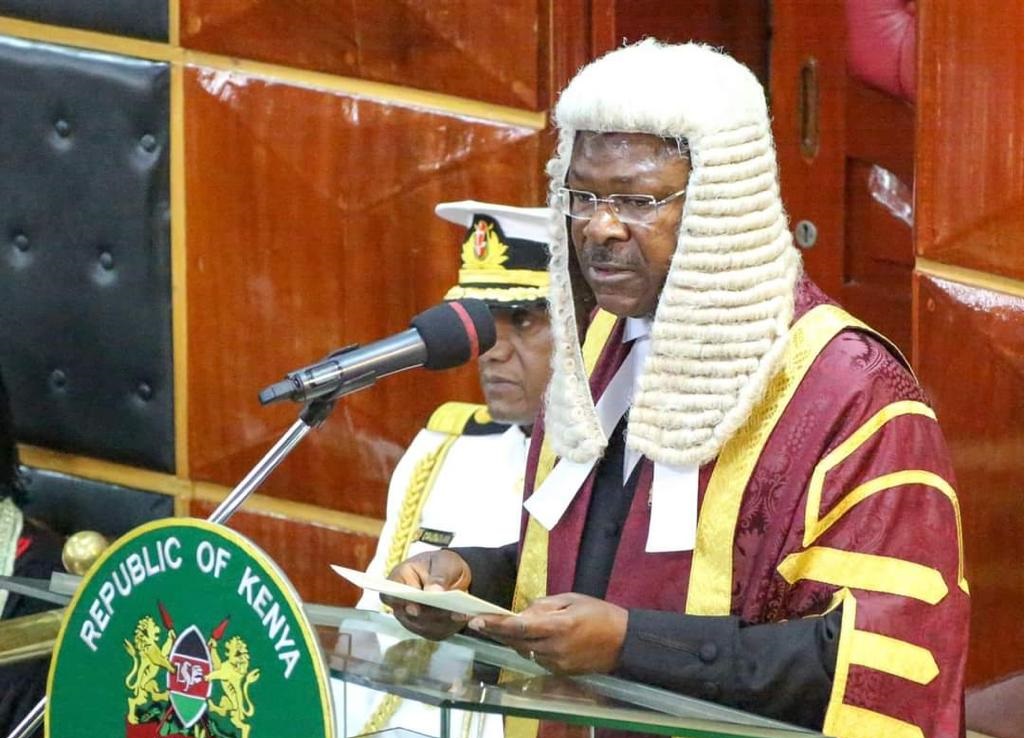

The arrests come in the wake of the Inspector General of Police Douglas Kanja receiving the KUSCCO forensic report from Cooperatives and MSMEs Cabinet Secretary Wycliffe Oparanya.

"This comes after the Inspector General of Police Mr. Douglas Kanja assured that the National Police Service will leave no stone unturned in investigating the matter, as he received the KUSCCO forensic report from the Cabinet Secretary for Cooperatives and MSMEs Wycliffe Oparanya," the statement added.

A recent forensic audit uncovered a significant financial scandal within KUSCCO, revealing that top executives forged the signature of deceased external auditor Alfred Basweti to endorse falsified financial statements.

According to the report, the fraudulent activity contributed to the misappropriation of approximately Ksh 13.3 billion of depositors' funds.

The audit, covering the period between 2018 and 2023, identified several malpractices including cooking of books, unauthorized withdrawals, conflict of interest, and loan irregularities.