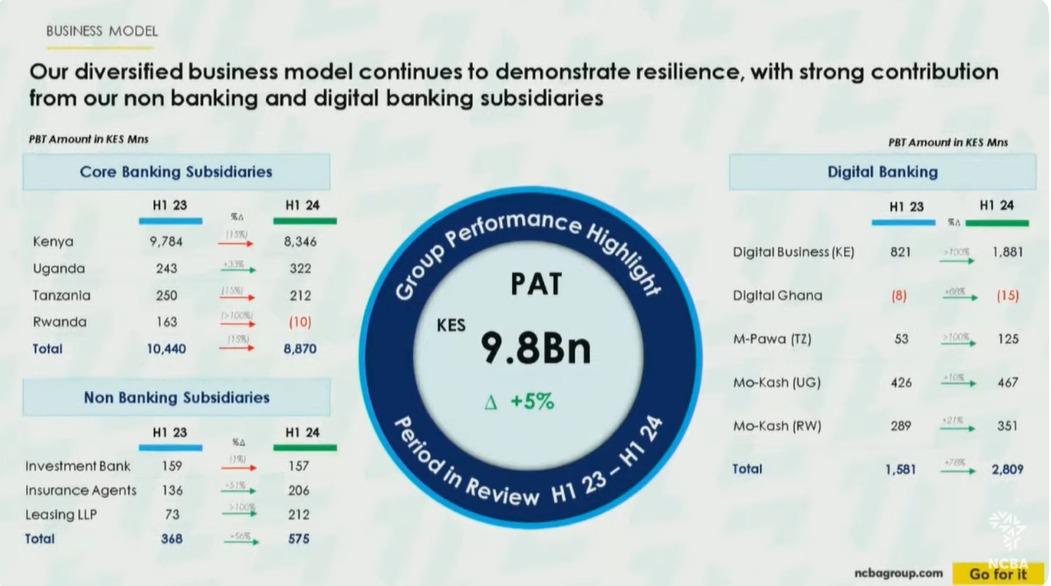

NCBA Group has announced a net profit of Ksh9.8 billion for the first half of 2024, reflecting a five percent growth.

Speaking on Thursday, August 22, during the release of the financial results, NCBA Group Managing Director John Gachora stated that the profit before tax was Ksh12.2 billion and that shareholders will take home Ksh2.25 per share.

During the period, NCBA's total assets grew to Ksh689 billion, and the bank recorded operating income of Ksh31 billion and operating expenses of Ksh16.5 billion.

"Our half-year profit after tax stands at Ksh9.8 billion, which is a 5% growth from where we were at the same time last year. We will be announcing that the board has approved the payment of an interim dividend of Ksh2.25, the highest we have paid as an organisation," Gachora remarked.

The NCBA boss further disclosed that the bank recorded a 20 percent Return on Average Equity (ROAE) and customer deposits closed at Ksh529 billion.

Read More

At the same time, Gachora noted that NCBA's investment in digital financial inclusion services enabled it to disburse Ksh478 billion in digital loans during the period.

The NCBA managing director also intimated that the bank had expanded its business after completing the acquisition of AIG Kenya, an insurance company.

He announced the bank's improved customer experience, adding that 87 percent of transactions were being executed digitally.

"Our core digital bank investments have improved and enhanced customer experience with 87% of our transactions now executed digitally with growing transactional volumes," Gachora explained.

Additionally, the NCBA boss disclosed that the bank increased its base to 116 branches

"We remain committed to being a distinguished brand known for customer experience. We're the 85th most valuable brand in Africa, the 6th most valuable Kenyan brand (brand finance) and top five most loved brands in Kenya," Gachora stated.

He, however, noted that the bank's profit margins were pressured due to a tight interest rate environment but affirmed that NCBA was committed to optimising its financial performance.

“Our banking business across the group delivered a collective profit before tax of Ksh11.7 billion in the period. These outcomes are flat year on year largely driven by a tight interest rate environment which has elevated our cost of funds and pressured our profit margins. Despite these challenges, we remain committed to strategically managing our balance sheet and optimizing our financial performance to sustain our growth trajectory,” Gachora explained.

-1770368133.png)