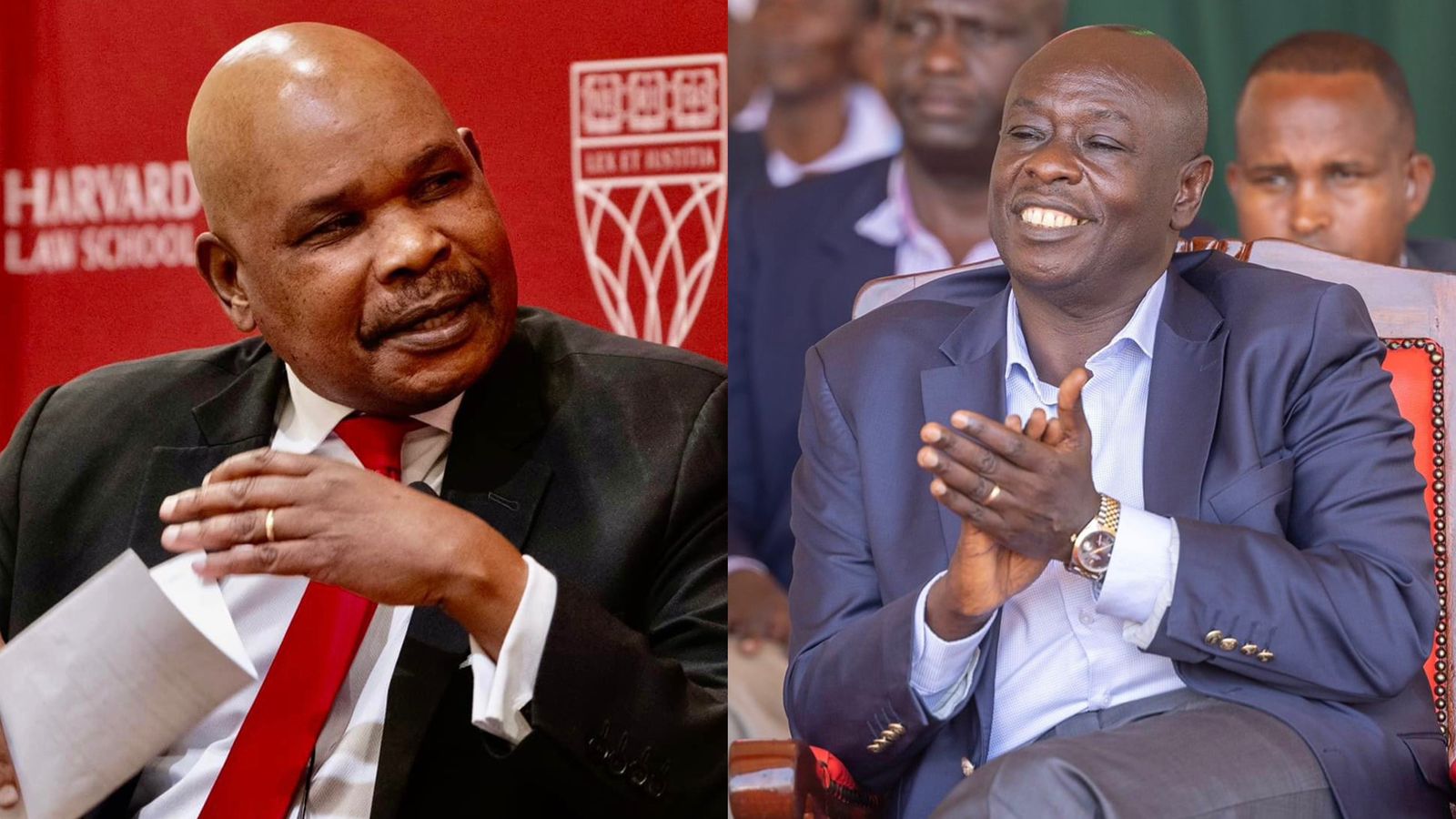

Communication Authority of Kenya (CA) Director General David Mugonyi has issued clarity following concerns by Kenyans over the new tax compliance system set to be introduced on mobile phones.

Speaking during a meeting with MPs on Wednesday, November 6, Mugonyi acknowledged that Kenyans had expressed concerns about data privacy.

According to the CA boss, the Kenya Revenue Authority (KRA) will not have access to data and transactions done on people's phones.

“This engagement has nothing to do with the transactions we carry out on our phones. We want to ensure the right products are in the country, and the tax compliance aspect is strictly for that. KRA will not have access to people’s data," he clarified.

Read More

The government officials explained that the system would only enable the taxman to ensure that all relevant taxes relating to the devices are paid.

"The system, Mr Mugonyi noted, is designed to send a notification to users who activate a new device without having paid applicable taxes. The unregistered device’s IMEI will then be placed on a blacklist, preventing it from connecting to any local network until taxes are settled," read the statement by Parliament in part.

On the other hand, he noted that the majority of the devices already used by Kenyans will not be affected by the latest directive.

Upon rollout, the new system will only affect mobile phones that have been connected to the local networks from November 1, 2024.