The Kenya Revenue Authority (KRA) has suspended tax reliefs indefinitely.

In a notice of Tuesday February 28, the taxman stated that the move would enhance the current processes related to the payment of tax refunds, exemptions, waivers, and abandonments.

“In a bid to enhance the current processes related to the payment of tax refunds, exemptions, waivers and abandonments, the Kenya Revenue Authority (ICRA) in concurrence with the National Treasury & Economic Planning has suspended all tax relief payments with effect from 25th February 2023 until further notice.

“In the past five years, KRA has granted tax reliefs and incentives totaling Ksh. 610 Billion, with an average of KShs.122 Billion per annum. The move to suspend payment of tax reliefs allows ICRA to audit and enhance the tax relief processes and procedures,” the notice read in part.

Read More

KRA also stated that move would help the government seal loopholes and enable the authority collect more taxes that will help grow the economy.

“ICRA is optimistic that the enhancement of the tax relief process and procedures will offer a permissible issuance of tax exemptions; it will also ensure equitable processing of tax reliefs. The improvement is part of the Government's strategy to seal revenue leakage and enable KRA to mobilise more taxes towards the country's economic growth,” the statement added.

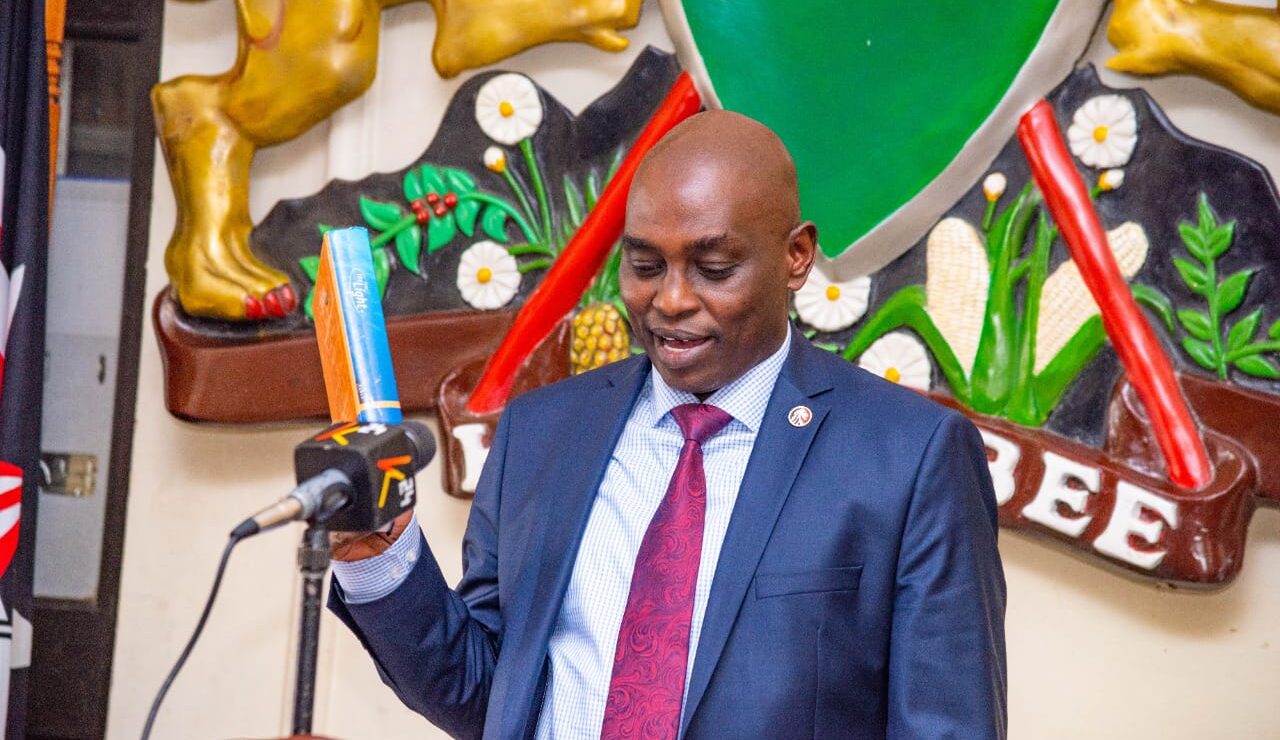

The announcement comes days after the KRA board appointed Rispah Simiyu as the acting Commissioner General following the resignation of Githii Mburu.