Economist David Ndii now says the auditing of the national debt would be competently done by auditors outside the government.

Reacting to a Kenyan's concerns about the Law Society of Kenya (LSK) president's appointment to the audit team, Ndii implied that the president was on point to constitute the committee.

According to Ndii, confining the audit to a statutory function would sabotage openness and transparency, given that the auditor general is a player in public finance management and thus cannot assess themselves.

"The public debt audit is not a statutory audit. The Auditor General does that every year—they would be repeating themselves. The task force will also advise on the PFM architecture. The Auditor General is part of the PFM architecture, so they cannot review themselves," he said.

For a time, there have been concerns that the debt is odious and that Kenyans can't account for its value.

Read More

The debt, currently at upward of KSh 10 trillion, was majorly procured during former president Uhuru Kenyatta's tenure.

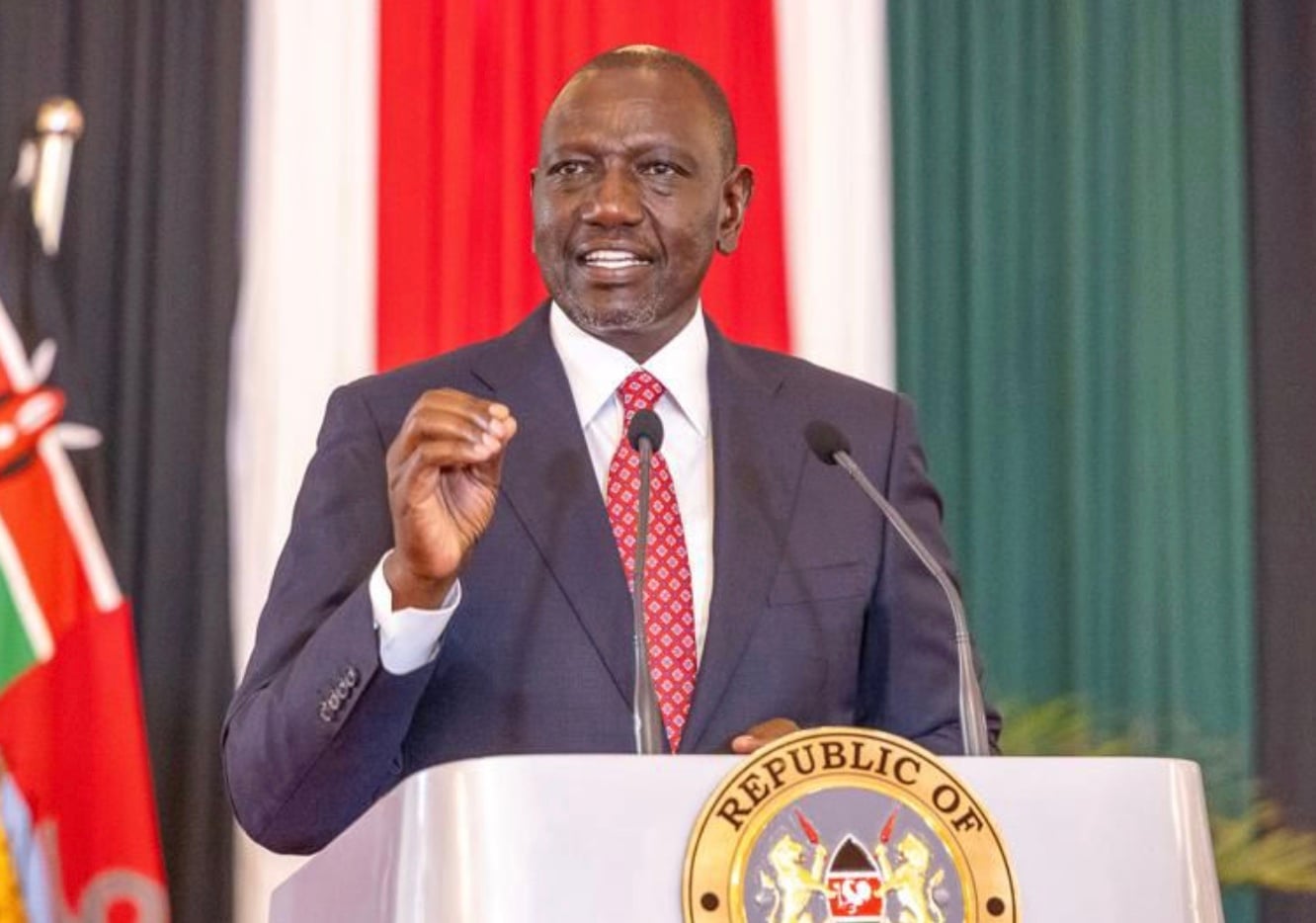

Ruto constituted the Presidential Task Force to conduct a forensic audit before filing its report within three months.

It will run its activities from the National Treasury building.

To lead the team as its chair will be Nancy Onyango, assisted by Luis Franceschi.

Members of the team include; Philip Kaikai, LSK President Faith Odhiambo, Institute of Engineers of Kenya President Shammah Kiteme, and Vincent Kimosop.

Abraham Rugo and Aaron Thegeya will serve as the joint secretaries of the task force.

The team will review the current stock of public and publicly guaranteed debt, reconciling loan proceeds with their intended purpose and reconciling loan repayments with the associated terms of the facility based on the context and terms of the loans.

The Task Force will also assess whether the country has received value for money in terms of loan terms, cost of the projects financed, return on investment, and equity, including intergenerational equity.

In addition, the task force will assess the adequacy of safeguards in the public finance management (PFM) framework for debt management and recommend changes in the control environment to strengthen the governance of the country's public debt management system.

“In the light of the current debt burden, the imperative for fiscal consolidation and the constrained fiscal space, recommend alternative sources of financing the country’s development needs in the short and medium term and any debt reorganization plan; and to consider, perform, or advise on any other matter or subject ancillary to the above,” the gazette notice read in part.