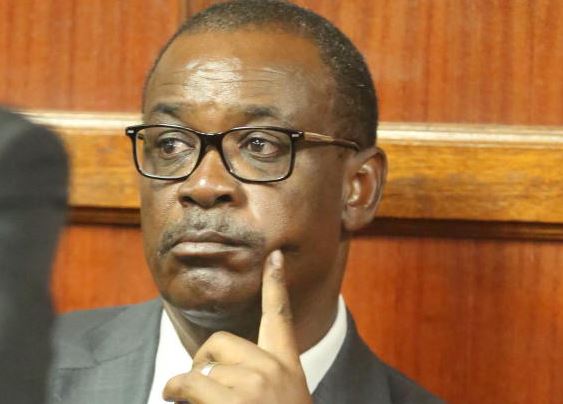

Former Nairobi Governor Evans Kidero has been handed a reprieve after he obtained a court order temporarily blocking Kenya Revenue Authority (KRA) from seizing Ksh427 million in his accounts at NCBA Bank over unpaid tax.

Kidero moved to court on Tuesday, February 15, 2022, after the taxman had ordered NCBA bank to surrender the money in his accounts over unpaid taxes.

A ruling by the High Court on February 7 found the former governor under-declared taxes.

According to court documents, Kidero stated that KRA wrote to NCBA on February 8, demanding the Ksh427 million in the middle of an appeal over the High Court judgment.

Read More

“The tax claimed is grossly excessive, punitive and the respondent (KRA) would suffer no prejudice should stay of execution be granted,” the former governor says.

Justice David Majanja granted him the temporary reprieve so that he could pursue an appeal.

This comes a week after the High Court had ordered Kidero to pay the taxman Ksh427,269,795.00 for the money he raised to finance his campaigns in 2017.

Justice Majanja in a ruling dated February 4, ruled that Kidero had failed to demonstrate how he had received the donations and if all the money went into the campaign.

The taxman conducted an audit on the money Kidero received but he maintained that it had been donated towards his gubernatorial campaign and thus remained immune to taxation.

“I agree with the Commissioner that the Respondent failed to discharge his burden as the evidence on record could not support the conclusions reached by the Tribunal.

“Consequently, the Tribunal erred in imposing on the Commissioner the burden of disproving the Respondent’s contention that the KES 423,000,000.00 was election campaign contributions when he had not provided sufficient evidence to surmount his obligation to establish this source of income,” said Justice Majanja.

The audit by KRA further revealed that Kidero was receiving the money into the same account as other proceeds from his businesses.

The taxman noted that Kidero and the commissioner had agreed that the money was received from donors to his campaign.

However, they failed to demonstrate whether all the money was used for campaign activities.

“When tasked to avail a bank account for his campaign funds, Kidero furnished the commissioner with names of various contributors and a single-page document titled Statement of Receipts and Expenditure indicating the monies received and expended on various items.

“Dissatisfied with this information, the commissioner raised a tax assessment for KSh427,269,795.00 that precipitated an appeal at the Tax Appeals Tribunal (TAT),” a statement by the Commissioner for Domestic Taxes (DTD), a department within KRA detailed.

-1771426103.jpg)