Controller of Budget Margaret Nyakang'o has raised concern over the country's debt limit.

As detailed in her report covering the implementation of the 2024/2025 budget between July and September. Nyakang'o noted that the debt ceiling had surpassed the required limit.

Nyakang'o explained that the law requires that the debt ceiling does not exceed 55 per cent of the GDP. However, as of September 30, the debt limit had grown to 67 per cent of GDP.

The CoB attributed this rise to growth in both domestic and foreign borrowing.

Read More

"As of 30th September 2024, the public debt stock stood at Ksh10.79 trillion (67 per cent of the GDP), comprising Ksh5.19 trillion due to external lenders and Ksh5.60 trillion due to domestic lenders. The public debt stock increased by 2 per cent from Kshs.10.58 trillion as of 30th June 2024 to Ksh10.79 trillion as of 30th September 2024.

"External debt increased by 0.3 per cent, while domestic debt recorded 4 per cent growth attributable to more borrowing in the domestic market. The public debt stock, therefore, surpassed the authorised public debt limit." read the report in part.

Consequently, she noted that the excessive borrowing would be prevented by reducing the deficits in the budget.

"The Controller of Budget recommends a reduction of budget deficit financing through fiscal consolidation to contain the increase in public debt," she added in the report.

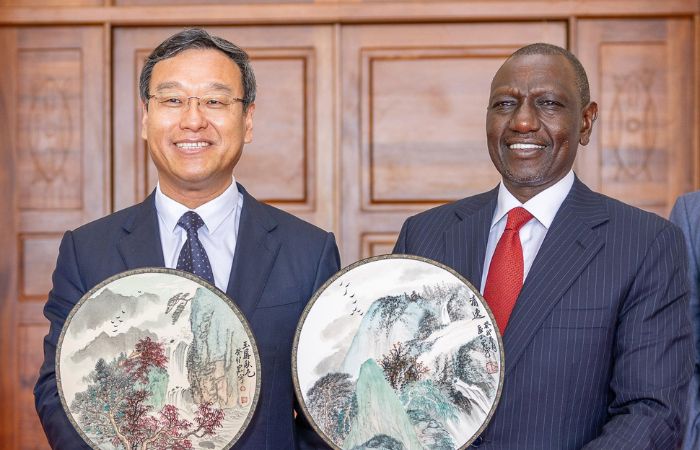

In the international market, Kenya relies on loans offered by countries such as China in addition to funding from Bretton Woods institutions such as the International Monetary Fund (IMF) and the World Bank.

Domestically, the country borrows from banks and other institutions.

-1683725821.jpg)