The government has announced plans to revise the proposed Ksh4.3 trillion budget for the 2025/26 financial year.

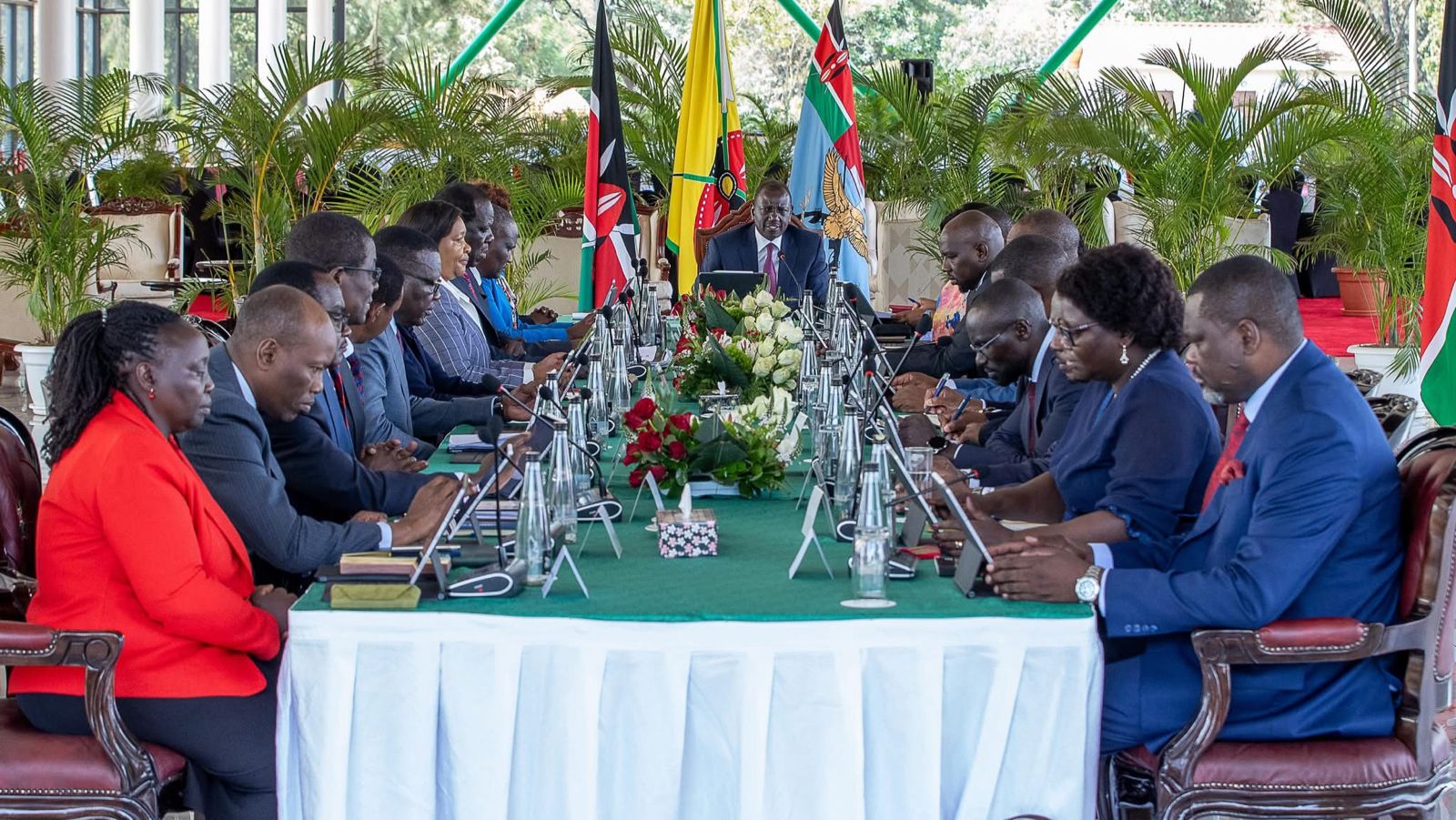

According to a statement released following a Cabinet meeting chaired by President William Ruto on Tuesday, April 29, the Cabinet approved budgetary realignments in what it termed as a move towards fiscal discipline and reducing public debt.

"The Cabinet has resolved to implement significant budget realignments in line with the government's policy of fiscal consolidation and commitment to living within its means. The initial budget estimates of Ksh4.3 trillion will undergo substantial revisions before being tabled in Parliament.

"These adjustments are part of broader austerity measures designed to strengthen fiscal discipline, reduce public debt vulnerabilities, and create the fiscal space necessary to deliver essential public goods and services," the statement read.

To actualize this, Ruto directed ministries and State departments to review their expenditures and implement necessary adjustments in close coordination with the National Treasury.

Read More

"Cabinet Secretaries were directed to work closely with the National Treasury to identify and implement necessary adjustments within their respective ministries and State departments.

"This move aims to cap the fiscal deficit at no more than 4.5% of GDP for the 2025/26 financial year, down from 5.3% in 2023/24, 5.1% in 2024/25, and with a medium-term target of reducing the deficit to 2.7%," the statement continued.

Additionally, the Cabinet gave the green light to the Finance Bill 2025, which places emphasis on curbing inefficiencies and plugging revenue leakages rather than increasing taxes.

According to the statement, rather than introducing new taxes, the Bill proposes an overhaul of tax administration laws to boost revenue collection and minimize legal delays.

"In furtherance of these objectives, Cabinet also approved the Finance Bill, 2025, which focuses primarily on closing loopholes and enhancing efficiency, including addressing loopholes related to tax expenditures that have historically been exploited to siphon funds from public coffers, such as through inflated tax refund claims.

"Importantly, the Bill seeks to minimise tax-raising measures. Instead, it aims to enhance tax administration efficiency through a new legislative framework. Key provisions include streamlining tax refund processes, sealing legal gaps that delay revenue collection, and reducing tax disputes by amending the Income Tax Act, VAT Act, Excise Duty Act, and the Tax Procedures Act," the statement added.

At the same time, in a bid to support small businesses, the proposed Bill includes a tax relief mechanism that allows faster deduction of expenses.

"Notably, the Bill proposes critical changes to support small businesses, allowing them to fully deduct the cost of everyday tools and equipment in the year of purchase, thereby eliminating unnecessary delays in accessing tax relief," the statement further read.