The Government has said the plan to raid M-PESA accounts of Hustler Fund defaulters is within the law.

In a statement to newsrooms on Wednesday, October 2, State Department for MSME's and Development PS Susan Mang'eni said the recovery measures will strictly adhere to data protection laws.

"The default recovery measures under consideration will be in line with laws of Kenya and particularly in strict adherence to data protection laws. The Hustler Fund Service providers partners' role remain provision of technology.

"We wish to assure Kenyans that the government remains committed to the adherence of data protection laws and the default recovery measures will be within the law," the statement read in part.

At the same time, the government encouraged Kenyans to pay back their loans to raise their credit score.

Read More

Appearing before the National Assembly’s Special Funds Account Committee on October 2, 2024, Financial Inclusion Fund (Hustler Fund) acting CEO Elizabeth Nkukuu said the government is planning to raid MPesa accounts of Kenyans who are yet to repay Ksh 7 billion to the Hustler Fund.

She further said that the deductions would also be made when the defaulters of Hustler Fund load airtime to their phones.

Nkukuu explained that the Government had reached a dead-end in their recovery bid, adding that 13 million Kenyans have borrowed from Hustler and have refused to pay back.

“What we are looking at is to get money from their MPesa or airtime, we are in the process of considering appropriate legal provisions. The beauty of this Fund is that we have the phone numbers and the unique identifiers of the defaulters, the national ID. They are people of means, they are people who just don’t want to repay,” she said.

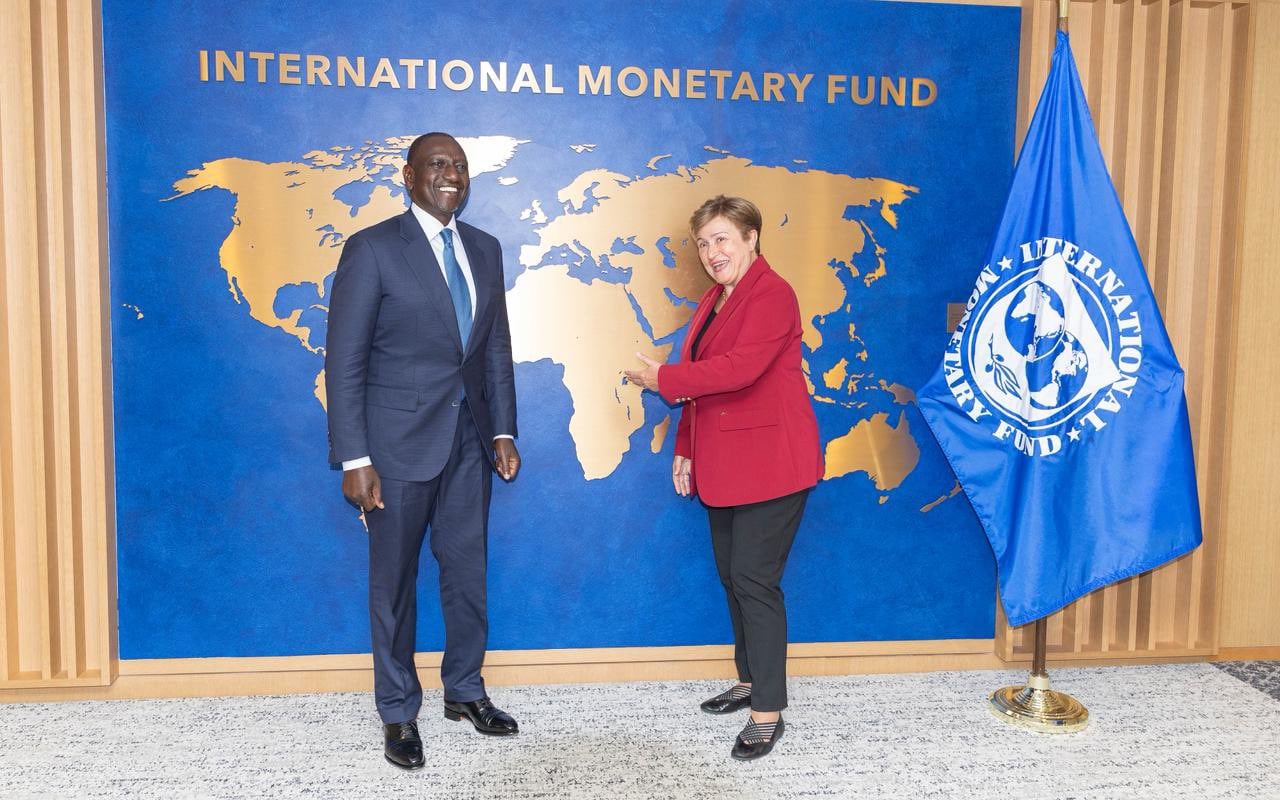

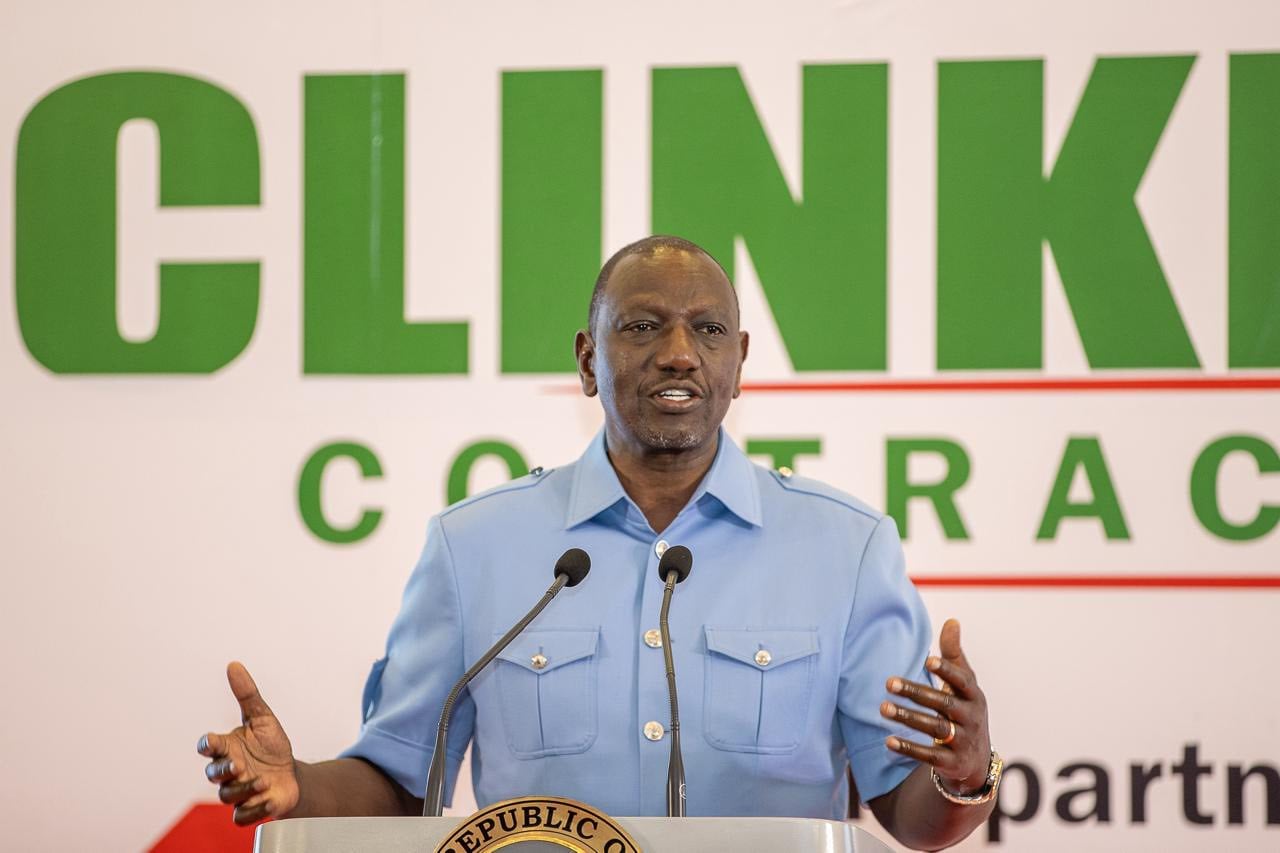

The Hustler Fund, launched in November 2022 by President William Ruto, was aimed at enhancing financial inclusion.

In June 2023, the Hustler Group Loan was introduced, allowing registered groups to access loans ranging from Ksh 20,000 to Ksh 1 million at a reduced interest rate of 7%.

-1758009840.jpg)