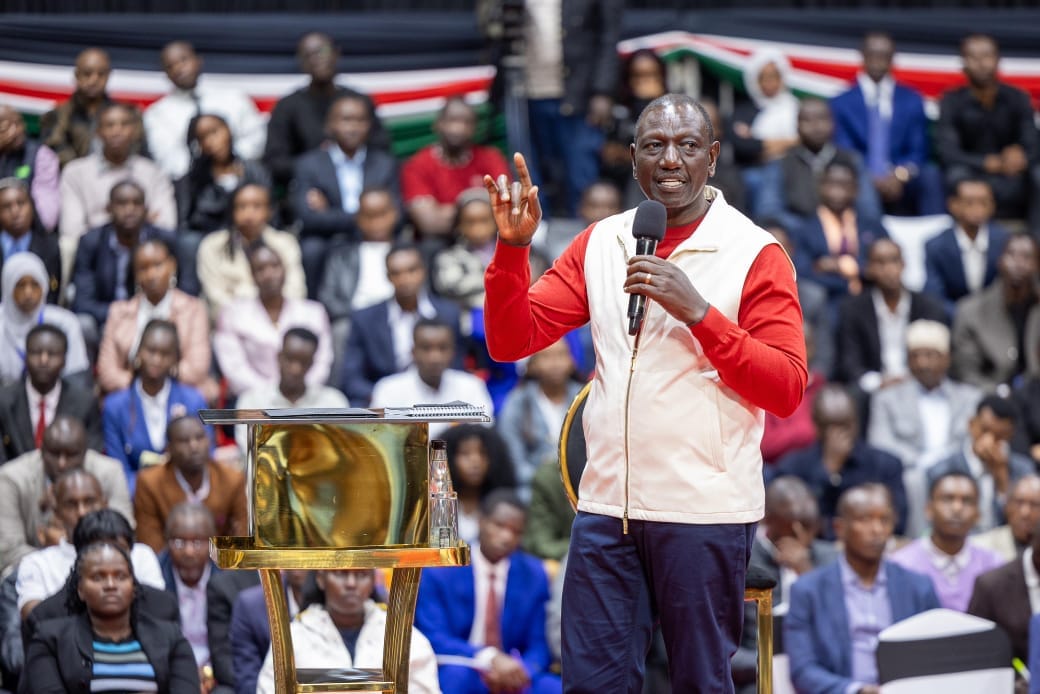

President William Ruto was on Sunday, August 25, put on the spot to explain what was wrong with the old funding model that they had to change.

The Head of State hosted a town hall meeting at KICC to engage university students on the Higher Education Funding Model which has caused uproar among Kenyans.

One of the students from KEMU University identified as Kisero Junior, asked the president what was wrong with the old funding model that they had to change it altogether.

"What was so wrong with the old funding funding model that we could not sit down and amend it," the student asked.

In a rejoinder, the President said that the old model assumed the government could pay 80% of fees for all students which was not the case.

Read More

"The old funding model was almost destroying our education system because it assumed that all the courses were the same. It also assumed that the government had the money to pay 80% for everybody when it did not, and the results were disastrous," Ruto stated.

The President said that due to the old funding model, most of the public universities were bankrupt when he came into office in 2022.

"When I came into office, because of the old funding model, 23 out of 40 public universities were bankrupt," remarked the President.

The President's sentiments were backed by a section of Vice Chancellors who said that the old model was giving universities a financial headache.

The University officials said that the new model would help them with a turnaround in finances so that they can get out of debt and become sustainable and pay lecturers on time as well as provide the needed resources to train students.

At the same time, the Head of State said that the banding did not start with this model and they would improve on it in due time.

"The new student-centred funding model has 5 bands. The banding did not start with this model. We started the banding in 1996. There has always been banding. I know there is a push that maybe this banding started with this model, it did not, it has always been there. All we did, instead of having 4 bands we made it 5," the President said.

He added, "We will continue to improve on the model, we are not saying the model is perfect but I think to a great extent it is towards 95% in the right direction and we will keep improving on it."

University Funding Bands

The new university funding model has categorized students into five bands based on family income. Band 1 is for families with a monthly income up to Sh5,995 while Band 2 covers families with a monthly income up to Sh23,670.

Band 3 is for families with a monthly income up to Sh70,000 and Band 4 is for families with a monthly income up to Sh120,000.

Families with a monthly income above Sh120,000 have been categorized in band 5

In band 1, the government scholarship will cover 70% of the university fees, with the loan covering 25% and the family will contribute 5%. The student receives an upkeep loan of Sh 60,000.

In band 2 the government scholarship will cover 60% of the fees, the loan will cover 30% and the family will contribute 10%. The student receives an upkeep loan of Sh55,000.

Read Also: Explainer: How Students Can Appeal University Funding Bands

Students in band 3 will get a scholarship covering 50% of the university fees, a loan covering 30% of the fees and their families will pay for the remaining 20% of the fee. The upkeep loan in this band will be Sh50,000.

In band 4, the government scholarship will cover 40% of the fees; the loan will cover 30%, making the total support 70%. The family will contribute 30% and the student receives an upkeep loan of Sh45,000.

Other the other hand, students in band 5 will receive a government scholarship of 30%; the loan will cover 30% and the family will contribute 40%. The student receives an upkeep loan of Sh40,000.

-1726491270.jpg)