The High Court of Kenya suspended the implementation of the 1% minimum tax and stated that the matter will be heard in its full merits before being finally determined by the Court.

On Monday, April 19 2021, the High Court granted conservatory orders restraining KRA from further implementation, administration, application and/or enforcement of Section 12D of the Income Tax Act by collecting and/or demanding payment of the Minimum Tax pending the hearing and determination of ongoing Petition.

Pronouncing himself on the matter, Justice Odunga said: "it is my view and I find that this is an appropriate case for the 2nd Respondent (KRA) to “hold its horses” for the time being as this Court navigates through the labyrinth of the respective contentions made by the parties herein."

He continued: "what the drafters of the Constitution intended is that the Court in determining the Constitutionality of an enactment ought to adopt what I would call “the guided-missile” approach so as to target only the offensive parts of the Act Accordingly, it is not far-fetched to say that further implementation of the Minimum Tax is likely to aggravate the situation, further sending the petitioners and businesses into the abyss."

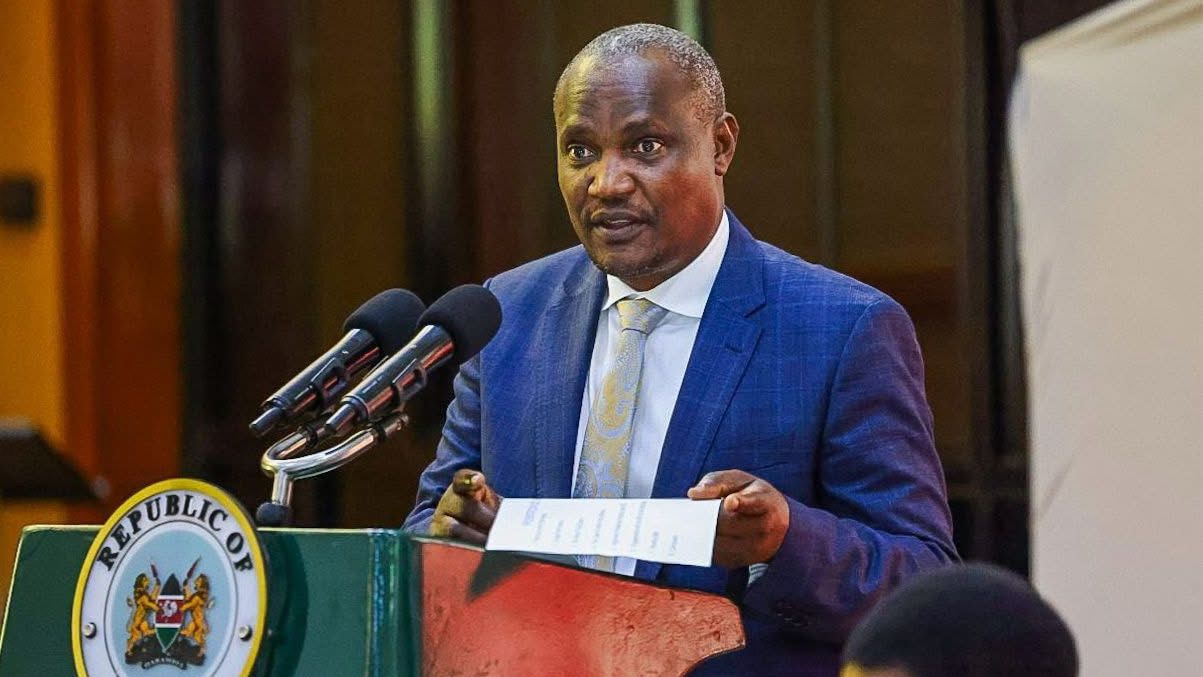

Last year Treasury CS Ukur Yatani proposed changes in the Finance Bill 2020 seeking the green light from Parliament to compel firms that have not been taxed elsewhere to pay one percent of gross sales to the KRA.

-1771737995.png)

-1772084019.jpg)