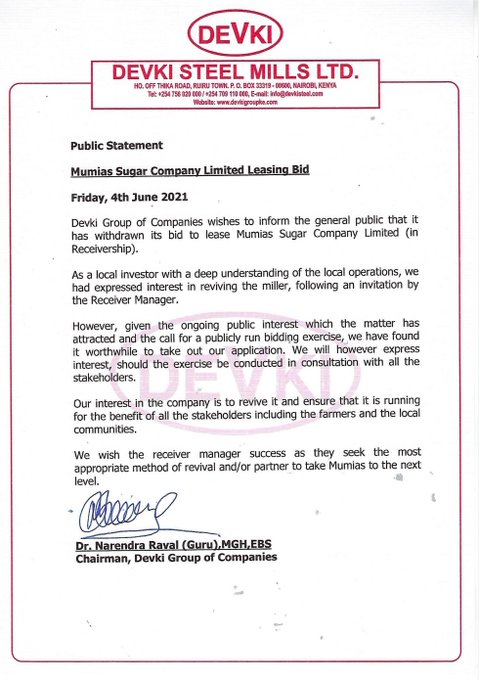

Devki Group has withdrawn a bid to invest in Mumias Sugar Company.

In a statement on Friday, Devki Group Chairman Narendra Raval noted that the withdrawal was influenced by growing calls for a publicly run bidding exercise.

“As a local investor with a deep understanding of local operations, we had expressed interest in receiving the miller following an invitation by the receiver manager. However, given the ongoing public interest which the matter has attracted and the call for a publicly run bidding exercise, we have found it worthwhile to take out our application.

“We will, however, express interest should the exercise be conducted in consultation with all the stakeholders,” the statement read in part.

Read More

Earlier this week, ANC leader Musalia Mudavadi appealed for transparency in the lease of Mumias Sugar Company by Kenya Commercial Bank (KCB) to Raval.

While addressing the media on June 2, 2021, Mudavadi noted that the sugar industry and its revival is critical to the country and most importantly the people of Western Kenya.

The ANC leader noted that the people of Western Kenya have earned a living from cane farming for a long time and the collapse of Mumias came as a massive blow.

"We must have a high level of transparency as KCB or the receivers are looking to get investors in," Mudavadi stated.

"The process must be done smoothly, and above board, because whoever that investor is, he will need the goodwill of the farmers.

"Therefore, the only way to win the goodwill of the public is for the process to be done transparently," he reiterated.

Raval is said to have tabled Ksh4 billion that will be used to restore operations at the ageing sugar plant and Ksh1 billion which will be used to pay sugarcane farmers to woo them back into the sector.

Raval embarks on the new adventure following successful stints in the steel and cement industries. He is the founder and owner of Devki Group of Companies majoring in steel and cement.

Poor management and piling debts plunged the sugar company to closure despite a previous record 250,000 tonnes a year production rate.

In September 2019, KCB placed the sugar company under receivership in a bid to protect its assets.

The Nairobi Stock Exchange (NSE) proceeded to suspend trading of MSC shares after operations wound up to a halt.

The leasing bid by Raval will come under scrutiny from the government which owns 20 percent, and creditors who are owed Ksh11 billion.

The company that will be awarded the leasing deal, will run operations at the Sugar Company while making monthly payments to KCB Bank which is owed Ksh545 million. This could take up to 15 years.

-1771737995.png)

-1772458092.jpg)

-1772456632.png)