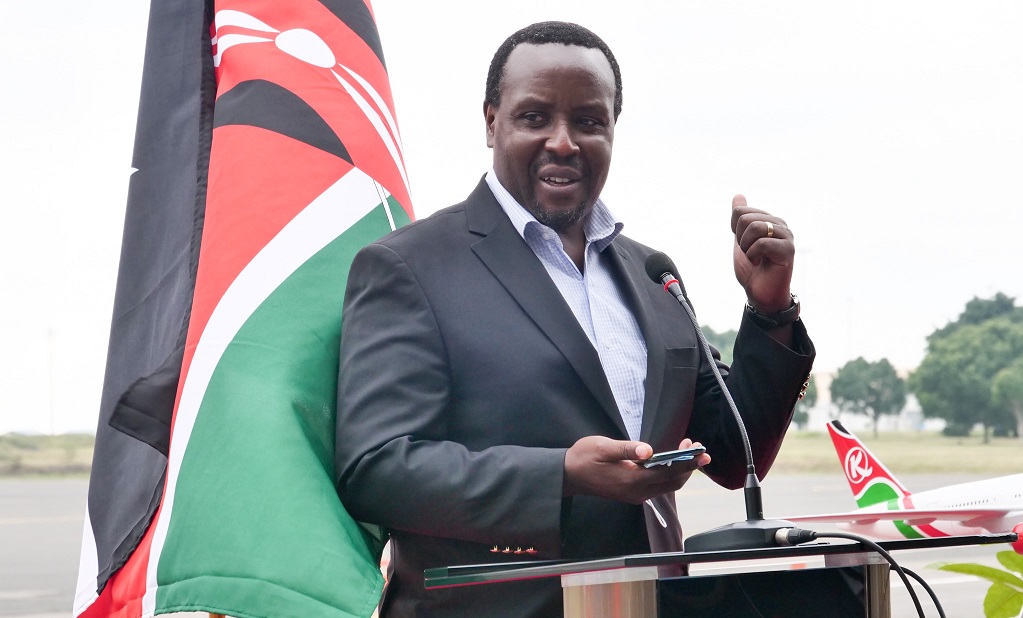

Treasury CS John Mbadi has directed State Corporations to effect budget cuts for 6 major expenses.

In guidelines published by the National Treasury over the 2025/2026 budget estimates on Friday, December 20, State Corporations were directed to reduce their estimates for legal fees, travelling and training.

Also listed in the budget cuts directive were expenses for seminars, consultancies and overtime.

"The base for 2025/2026 FY expenditure estimates should be the approved rationalized budget for 2024/2025 FY with a minimal projected increase to cater for cost-of-living adjustment," read the circular in part.

Read More

"Consequently, expenditures not supportive of the core mandate of the corporation like travelling, training, seminars, consultancies, legal expenses, overtime, and all non-core activities should be scaled down to the bare minimum."

On the other hand, the CS also cautioned the corporations against employee salary increments and loans.

According to the CS, all salary increments for employees must be approved by the National Treasury and the Salaries and Remuneration Commission (SRC).

"State Corporations are reminded that they should not procure any loan, overdraft facility and/ or any form of credit facility with a financial institution without prior approval of the Cabinet Secretary, Line Ministry with the concurrence of the Cabinet Secretary, the National Treasury & Economic Planning," Mbadi added.

"The National Treasury & Economic Planning will not give concurrence for borrowings or, where applicable, grant guarantees for State Corporations which are in default of loan repayments and pending bills."

-1758009840.jpg)