All Kenyans and non-resident individuals are required to file income tax returns annually on or before June 30.

The process often seems difficult for individuals with no background as accountants but it is quite doable.

In case one is not formally employed then they are required to file a nil return.

Failure to file returns on the due date attracts a Ksh.20, 000 penalty fee.

Here is a simple guide to filing tax returns with a P9 form provided by your employer:-

Read More

- Get your P9 form from your employer

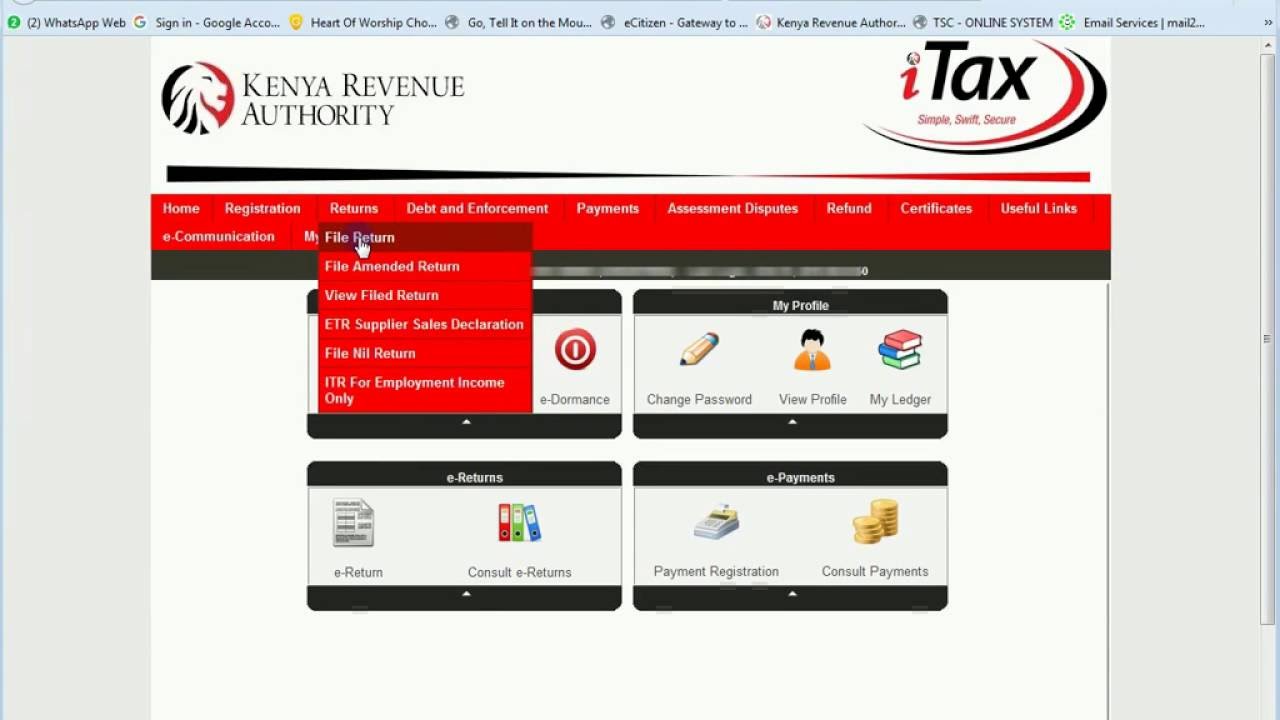

- Open your browser and go to itax.kra.go.ke

- Enter your KRA PIN/User ID and password

- Answer the security question that follows then log in

- Update your professional details appropriately and proceed

- Go to Returns Menu and select ‘FILE RETURNS’ ITR For Employment Income Only

- Select the tax obligation (Income Tax-Resident Individual) and click NEXT

- Click to download the Income Tax Return form using the provided link

- Enter your PIN, Type of return, return period FROM, and return period to (01/01/2019 – 31/12/2019)

- Go to sheet F and enter EMPLOYER PIN, NAME OF EMPLOYER, GROSS PAY, ALLOWANCES, and BENEFITS from employment as per the P9 form

- Go to sheet M and select the pin of the employer from the dropdown menu, enter the name of the employer, taxable salary, tax payable on taxable salary (chargeable pay), and amount of tax deducted as per the P9 form

- Go to sheet T ‘Tax Computation’ and the figure as is on your P9 form. Enter your personal relief (where applicable)

- Once you have confirmed the details you have entered match what is on the P9 form, validate and generate the upload file

- The file will be saved automatically

- Enter the return period if filing for the first time

- Upload the form by choosing the zip file, agree to the terms and submit

- Download the receipt that will be generated

The biggest challenge for taxpayers is working with a computer that is Excel-ready so make sure your computer supports all the functions of the spreadsheet.