The Kenya Revenue Authority (KRA) has announced that it is integrating artificial intelligence (AI) technology to detect tax fraud.

In a statement on Monday, October 14, KRA noted that the integration of AI will help in identifying tax leakages and make the tax collection process more efficient.

"KRA is integrating AI to streamline processes, detect fraud, and enhance compliance. AI will help identify tax leakages and provide deeper insights into revenue streams, making tax collection more efficient and accurate," KRA remarked.

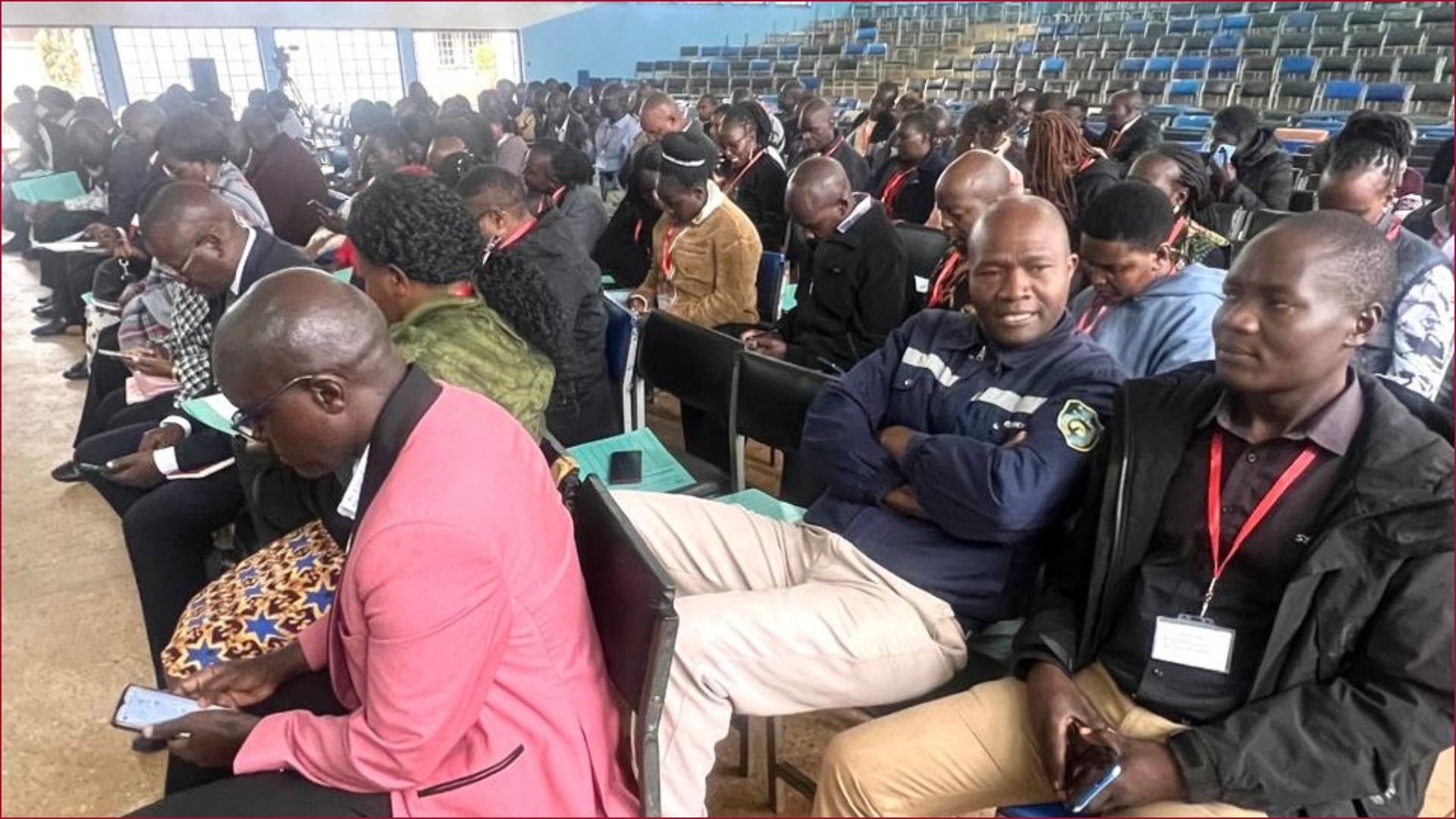

According to the taxman, the resolution was reached following a 3-day KRA Tax Summit that brought together policymakers and stakeholders from various sectors to discuss the future of taxation.

Among other resolutions made during the summit held from Monday, October 7 to Wednesday, October 9, is the personalization of services and enhancing taxpayer education.

Read More

"KRA is focused on making tax collection simpler and more transparent. By improving communication channels, offering personalized services, and enhancing taxpayer education, KRA aims to make the tax process more user-friendly and less intimidating for all Kenyans," the taxman stated.

The authority maintained that it recognizes the importance of putting taxpayers at the centre of every policy and reform, thus aims to build trust and foster voluntary compliance.

At the same time, KRA disclosed that it was working with other countries to reduce trade barriers and strengthen Kenya's competitive edge in the global market.

"The summit emphasized the importance of cross-border collaboration under the African Continental Free Trade Area (AfCFTA). KRA is working with other countries to reduce trade barriers, streamline trade flows, and strengthen Kenya’s competitive edge in the global market," KRA explained.