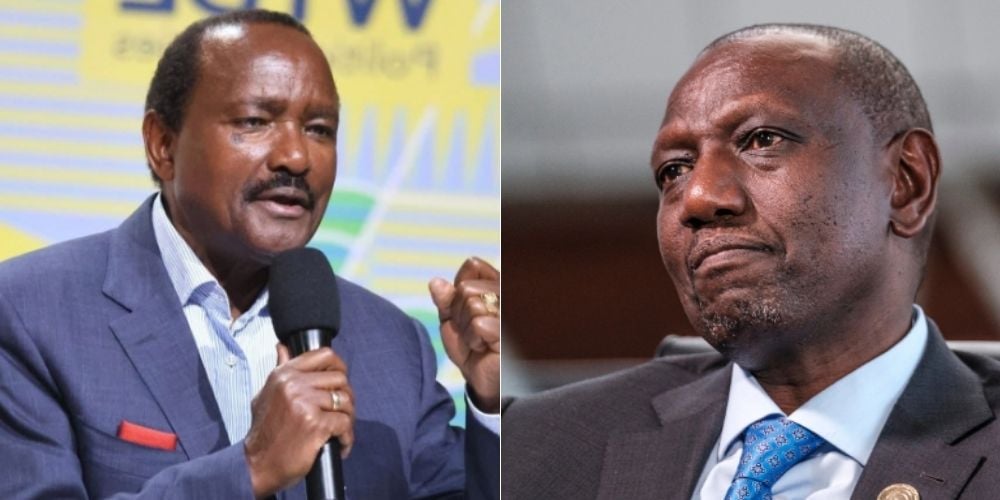

Wiper Party leader Kalonzo Musyoka has threatened legal action against the government over its decision to sell a 15 percent stake in Safaricom to Vodafone Kenya, warning that the transaction lacks proper public participation and may undervalue the national asset.

Speaking on Monday, December 8, Musyoka accused the government of preparing to dispose of the shares at a price below their true worth and suggested that corruption may be involved in the deal.

"Safaricom belongs to the people of Kenya, and it cannot just be auctioned," the former Vice President declared, adding that he has assembled a legal team to challenge the transaction.

"If the Safaricom shares are sold under value, we all know that there is a big cut. Somebody is about to steal big time," Musyoka alleged.

The Wiper leader emphasized his determination to halt the sale.

Read More

"We will stop them, and therefore we have a team of 100 advocates to stop this nonsense of selling without public participation, this national asset."

Safaricom announced on Thursday, December 4, that Vodafone Kenya intends to purchase an additional 6 billion ordinary shares from the government, representing a 15 percent stake in the telecommunications giant.

The transaction is valued at Ksh34 per share, totaling Ksh204.3 billion (approximately $1.6 billion). Additionally, the government will receive an advance payment of Ksh40.2 billion as compensation for future dividends, raising the overall transaction value to Ksh244.5 billion.

Once completed, Vodafone's shareholding will increase from the current 39.9 percent to 55 percent, making it the dominant shareholder.

The Kenyan government will retain 20 percent ownership, while public investors will hold the remaining 25 percent.

The sale has sparked controversy over the valuation of Safaricom shares. Kiharu MP Ndindi Nyoro criticized the pricing, noting that Safaricom shares traded at an average of Ksh45 in 2021, which would have valued the company at Ksh1.8 trillion before its entry into the Ethiopian market.

Nyoro contended that Safaricom's current valuation should exceed Ksh2.5 trillion, arguing that selling at Ksh34 per share represents either incompetence or conflicts of interest benefiting the buyers.

However, National Treasury Cabinet Secretary John Mbadi defended the government's position, clarifying that the value of an enterprise differs from the market value of its shares.

"The value of the shares is not equal to the value of the firm," Mbadi explained on Friday, December 5.

He noted that while Safaricom as an entity might be worth Ksh2.5 trillion, the share sale must reflect market prices rather than the company's total valuation.

The Treasury CS revealed that the Ksh34 price point was determined by calculating the average share price over the preceding six months, with an additional premium included.

"There will be no staff redundancy, the management and management structure in terms of governance of the company still remains, the CEO and Chairman will be Kenyan, and the majority of independent board members will be Kenyan citizens," Mbadi assured.