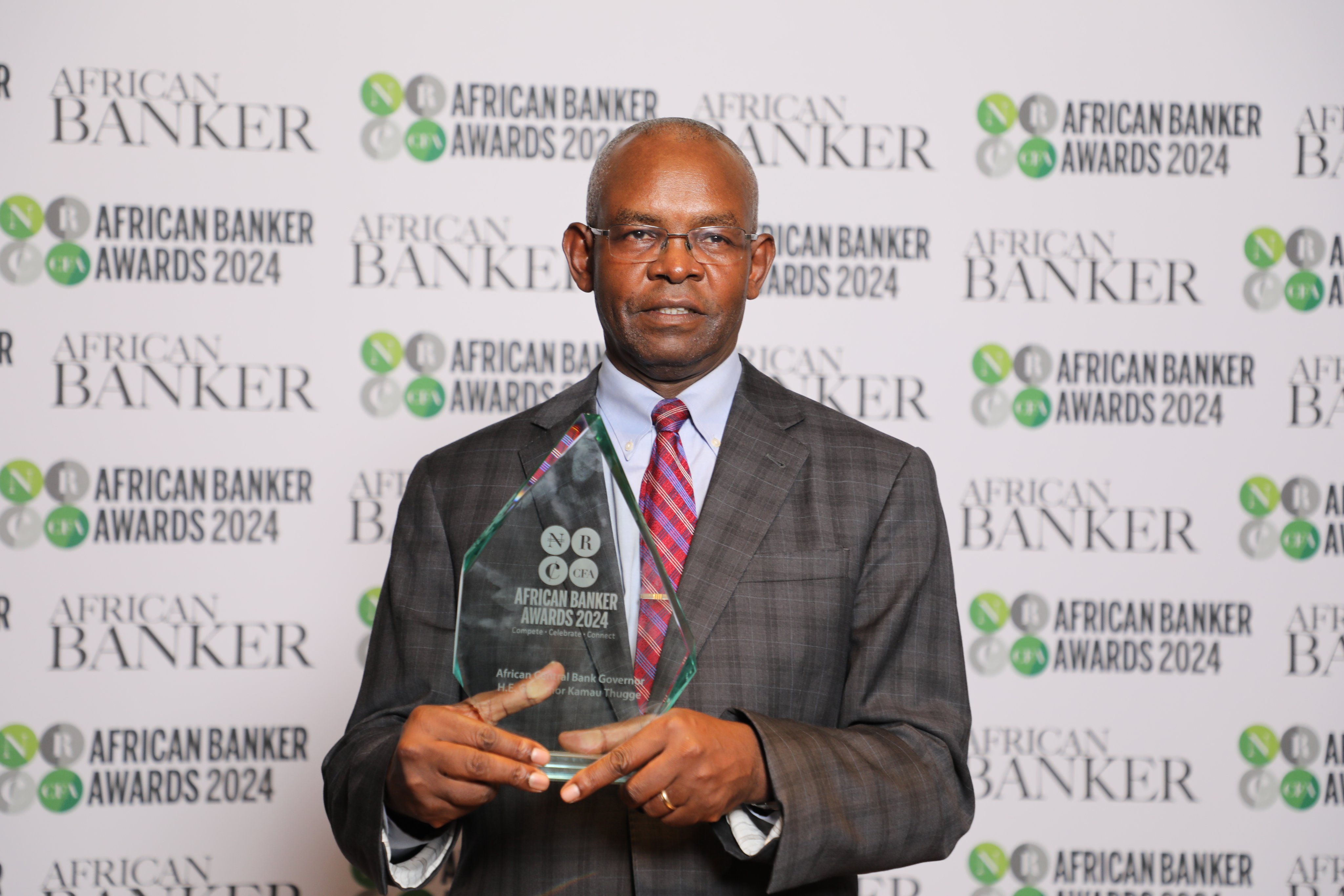

The Central Bank of Kenya (CBK) has announced that it has licensed an additional seven Digital Credit Providers (DCPs).

In a statement on Thursday, June 27, CBK disclosed that the number of licensed digital lenders is now at 58 after licensing 19 DCPs in March 2024.

The seven additional licensed digital lenders include ED Partners Africa Limited, Ismuk Credit Limited, Mint Credit Limited, Mogo Auto Limited, Payablu Credit Limited, Progressive Credit Limited and Stride Credit Limited.

"The Central Bank of Kenya (CBK) announces the licensing of an additional 7 Digital Credit Providers (DCPs). This is pursuant to Section 59(2) of the Central Bank of Kenya Act (CBK Act). This brings the number of licensed DCPs to 58 following the licensing of 19 DCPs announced in March 2024," read part of the statement.

The details of the 58 digital lenders which have been licensed by the CBK can be accessed through https://www.centralbank.go.ke/wp-content/uploads/2024/06/LicencedDCPsJune2024.pdf

Read More

The monetary authority intimated that it had received more than 550 applications since March 2022 and was working closely with the applicants in reviewing the applications.

CBK further noted that it engaged other agencies and regulators pertinent to the licensing process with a focus on business models, consumer protection and propriety of proposed shareholders, directors and management.

"This is to ensure adherence to the relevant laws and importantly that the interests of the customers are safeguarded. We acknowledge the efforts of the applicants and the support of other regulators and agencies in this process," CBK remarked.

According to CBK, other applicants are at different stages in the process and are largely awaiting the submission of requisite documentation.

"We urge these applicants to submit the pending documentation expeditiously to enable completion of the review of their applications," CBK stated.