Safaricom has partnered with the Higher Education Loans Board (HELB) to roll out a smart mobile payment solution for students of tertiary institutions to access and utilise their loans and bursaries.

The solution will aid HELB to promote responsible spending with the funds locked for specific allocations, such as tuition or library fees only accessible to the specific Paybill account of the recipient's University or TVET institution.

The students' upkeep allowance can now also be transferred into the student’s M-PESA wallet for everyday use.

Speaking on the partnership, Safaricom Chief Financial Services Officer Sitoyo Lopokoiyit said that, “Technology today is not only revolutionizing every aspect of our lives but also creating opportunities to enhance efficiency and accountability. We are pleased to support the Higher Education Loans Board to deploy a solution that suits the digital lifestyle of students in tertiary institutions."

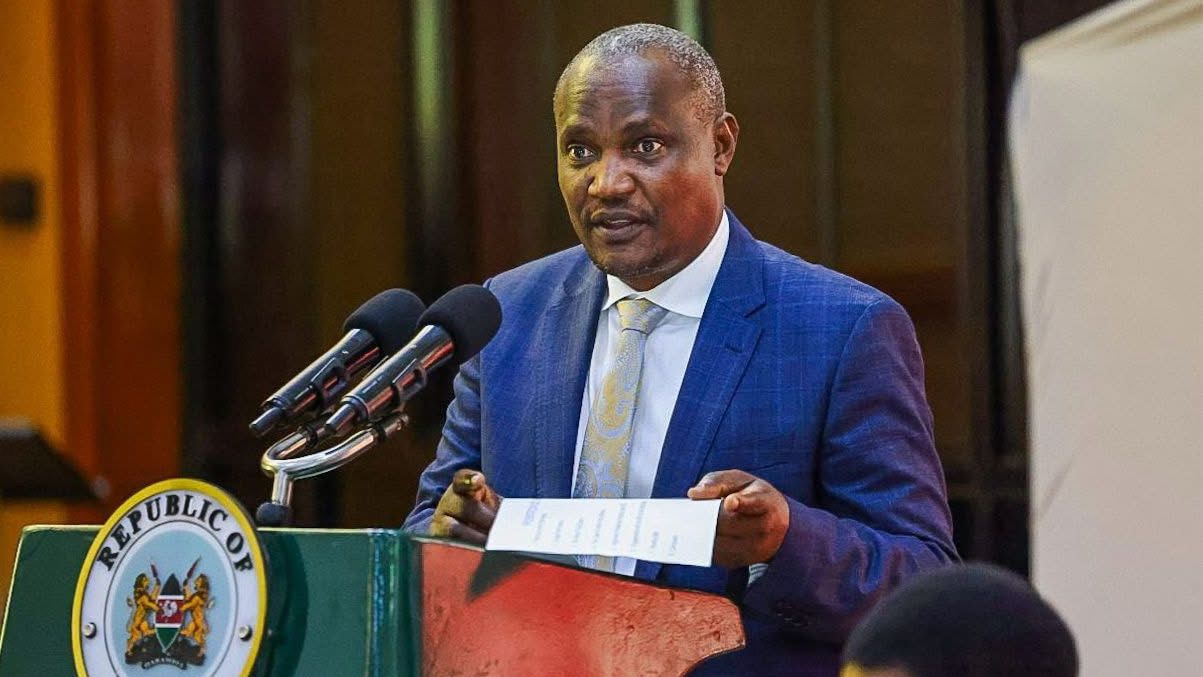

HELB’s Chief Executive Officer Charles Ringera noted that that the partnership was a major milestone in their digitization journey.

Read More

“The rollout of this smart solution marks a major milestone in our digitisation journey. It not only enhances efficiency in our operations, but also enables us to step up the experience of beneficiaries, who are digital natives. The solution will allow the student to access and make transactions within the solution’s ecosystem," Ringera stated.

Students can access the system through HELB USSD and the mobile app once completed from where they will view their loan allocations, current balances, statements and make payments.

HELB disburses over KSh 15 billion to over 200,000 beneficiaries annually. Part of the loan is usually channelled directly to the learning institution to settle part of the tuition and accommodation fees while the rest is sent to the student for upkeep.

How the Mpesa Solution will benefit both students and HELB:

- Create efficiencies for all stakeholders by reducing queues during registration as students can now pay through their mobile phones

- Effective management and monitoring of all loans throughout the loan lifecycle.

- Timeliness through mobile technology

- Accuracy on the phone holder

- Evidence-based data in regard to where and to who the money was disbursed

- Cost minimization on disbursement both to the students and HELB

- Versatility in what the owner of the money can use in utilizing the funds through disbursements – tap and go for the students through NFC technology that we understand Safaricom is about to rollout

- Mobile money disbursements will help HELB understand customers ad better serve their needs through analytics

- Corporates like Safaricom, Counties, Constituencies, development partners, parents to utilize the mechanism more efficiently and optimally in decision making of who to fund – case for professional fundraisers…this will improve sustainable financing of students in HLIs

-1771737995.png)