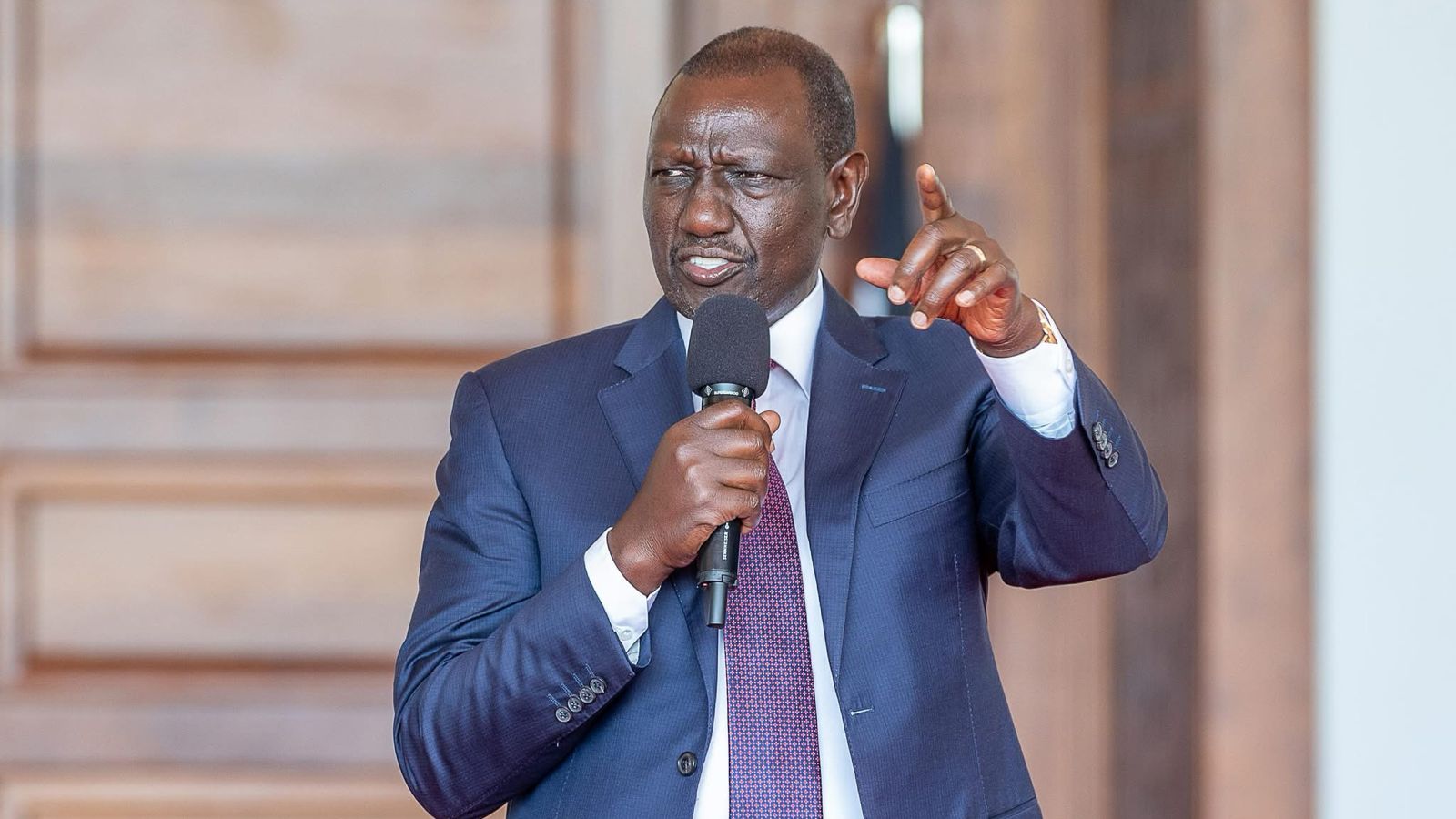

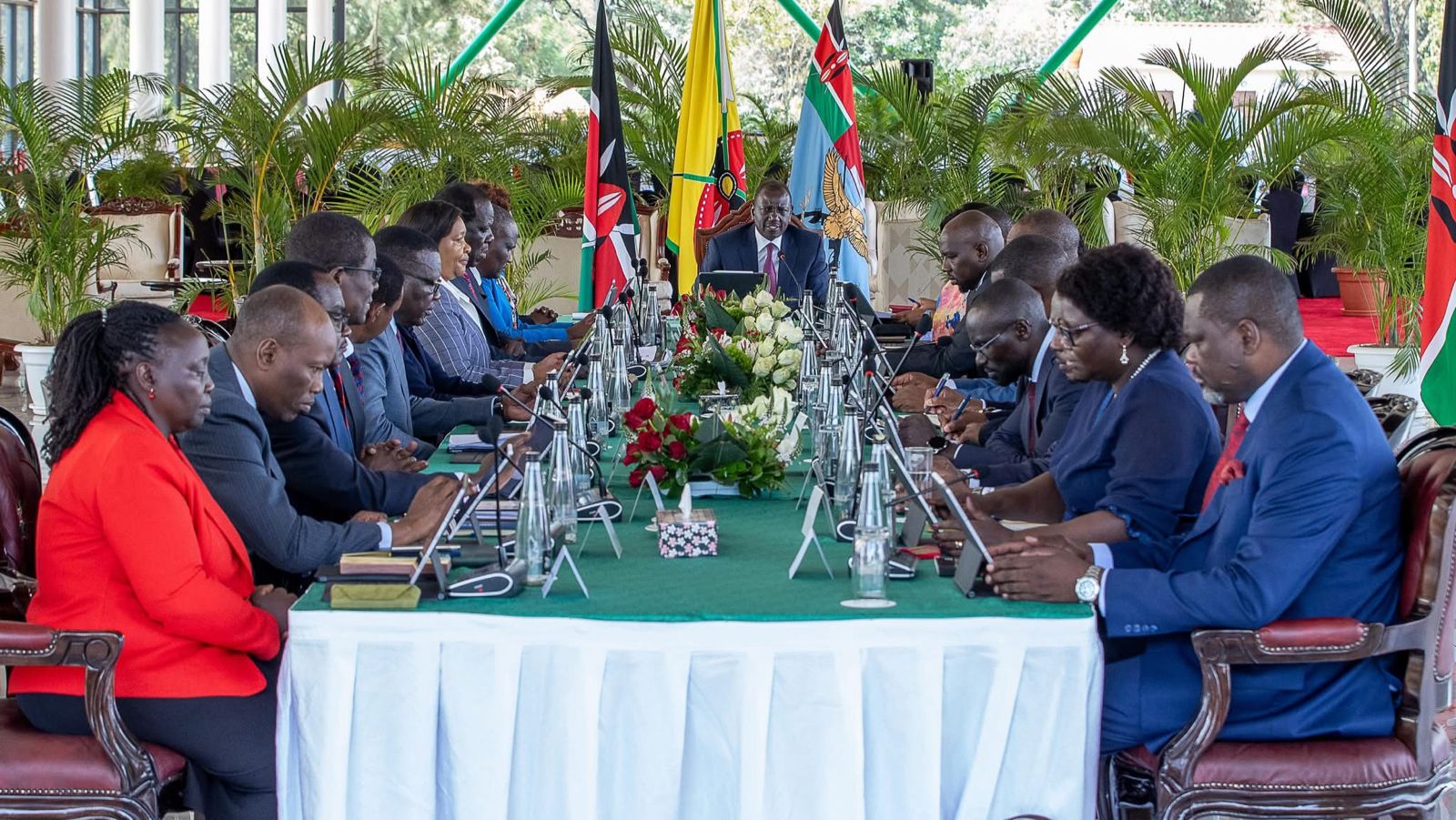

The Finance Bill 2025 was tabled in Parliament on Thursday, April 30, following the approval by President William Ruto's Cabinet.

The bill proposes a raft of changes targeting employees, employers and businesses through amendments to the Income Tax Act and Value Added Tax Act, among others.

Here are some of the major highlights

Employees and Employers

First, the bill seeks to increase the tax-free rate on per diems from Ksh2,000 to Ksh10,000. Per diems are allowances paid by employers to their employees when they are sent to the field.

Read More

Additionally, the bill proposes to make all pension gratuity payments tax-free. This will see retired Kenyans take home more after their employment, as gratuity is a one-time payment made to an employee upon retirement.

"The First Schedule to the Income Tax Act is amended in Part I in the proviso to paragraph 53 by deleting subparagraph (a) and substituting therefor the following new subparagraph- (a) payment of gratuity and by inserting the following new subparagraph immediately after subparagraph (a)- (aa) other allowances paid under a public pension scheme," proposed the bill.

"Employers will also be required to automatically apply all eligible tax reliefs and exemptions when calculating Pay As You Earn (PAYE) taxes for employees. Currently, many employers omit these reliefs, forcing employees to seek refunds from the Kenya Revenue Authority," State House added in its explainer.

VAT Changes

The proposed bill also seeks to make some goods and products VAT-exempt from the previous category of zero-rated.

They include inputs or raw materials (either produced locally or imported) supplied to pharmaceutical manufacturers for the manufacture of medicines.

Inputs or raw materials, locally purchased or imported, for the manufacture of animal feeds were also included in the lists.

The others are the transportation of sugarcane from farms to factories, the supply of locally assembled and manufactured mobile phones, the supply of electric bicycles and electric buses, the supply of solar and lithium-ion batteries, and the packaging materials for tea and coffee.

By making the items VAT exempt, businesses will not be able to seek VAT refunds from the taxman as was the case with zero rates.

Equally, the bill seeks to seal loopholes that are often used by businesses in seeking VAT refunds from the taxman.

"Where a person imports or purchases goods or services which are exempt or zero-rated and the person subsequently disposes of, or uses, the goods or services supplied in a manner inconsistent with the purpose for which the goods or services were exempted or zero-rated, the person shall be liable to pay tax on the goods or services at the applicable rate at the time of disposal or inconsistent use," read the statement in part.

Export and Investment Promotion Levy

The bill also proposes to reduce the Export and Investment Promotion Levy from 17.5 per cent to 5 per cent for some construction materials.

This is aimed at reducing the cost of construction in the country.

The items targeted in the move include semi-finished products of iron, bars and rods of iron or non-alloy steel.

Withholding Tax

Under the new proposals, withholding tax will be introduced to those who supply goods to public entities.

The tax will also be included for the sale of scrap.

"Section 10 of the Income Tax Act is amended in subsection (1), by adding the following new paragraphs immediately after paragraph (k)- (1) supply of goods to a public entity and (m) sale of scrap," the bill read in part.

-1739607673.jpg)

and several meter token (right)-1734971076.jpg)