President Uhuru Kenyatta on Wednesday unveiled the new brand of EquityBCDC, a subsidiary of Kenya’s Equity Group Holdings Plc in the Democratic Republic of Congo.

President Kenyatta also toured the towering 18-floor Equity Centre building in Kinshasa, the head office of Equity BCDC which will also serve as the head office for the Central Africa region where Equity is looking for its next phase of regional expansion.

Speaking during the unveiling ceremony, President Kenyatta congratulated Equity for the milestone of its successful acquisition, integration, and merger to create EquityBCDC which is now the second-largest commercial bank in the Democratic Republic of Congo.

The merged entity, EquityBCDC, has a balance sheet in excess of USD 3 billion and a nationwide footprint of 74 branches, 214 ATMs, 13 local dedicated desks, 3055 agents, a staff compliment of 1156, and a customer base of over one million.

With the merger, Equity Group successfully combined BCDC’s heritage of 112 years in the DRC market, with its established track record in corporate banking; together with Equity Bank Congo’s solidly strong focus on financial inclusion.

Read More

President Kenyatta urged private investors to optimize on the opportunities availed by regional cooperation frameworks such as the Africa Continental Free Trade Area (AfCFTA) to create regional supply chains, observing that the effect of the COVID-19 pandemic had created a paradigm shift in global supply chains such as health, agriculture, and manufacturing.

He commended regional financial networks such as Equity Group Holdings for playing an important role in the success of regional cooperation by providing a seamless financial services intermediation across different markets.

The African Continental Free Trade Area (AfCFTA) aims to, among other goals, create a single market, deepen the economic integration of the continent, aid in the movement of capital and people, facilitating investment, achieve sustainable and inclusive social-economic development, and to encourage industrial development through diversifications and regional value chains, agricultural development and food security.

Speaking during the ceremony, Dr. James Mwangi, Equity Group Managing Director and CEO of Equity Group Holdings said, “With its size, footprint, experience, aspiration and ambition, EquityBCDC has the distinctive capacity and unique capability to significantly contribute to positive transformation in the lives of the people of the Democratic Republic of Congo.

Dr. Mwangi added that Large corporate clients will particularly benefit from local credit facilities to the tune of USD 40 million on a Single Obligor Limit. By leveraging Equity Group’s balance sheet, lending capacity on a Single Obligor basis can be set as high as USD 350 million, allowing Equity BCDC to make a real contribution to turn-key structural projects and the economy of DRC.

As a subsidiary of Equity Group Holdings, Equity BCDC will add to the Groups’ capability to play a key role in regional economic development by facilitating cross border trade especially through trade finance and payments.,” Dr. Mwangi added that the expansion of Equity in the region strengthens Kenya’s position as a regional financial hub and diversifies the country’s exports beyond agricultural produce, manufactured goods, and raw materials to include financial services.

Celestin Mukeba, the Managing director of EquityBCDC said “EquityBCDC gives our over one million clients unrivaled access to a deep and wide franchise of banking expertise, channels and products, thus making it the largest existing financial services network in the DRC. We are building DRC’s first fully digital bank. Clients will benefit from Equity’s leading market position in the card payments sector (both credit and debit), first-in-class mobile banking applications, real-time internet banking and the full integration of bank accounts with the leading mobile wallets available in DRC and abroad.”

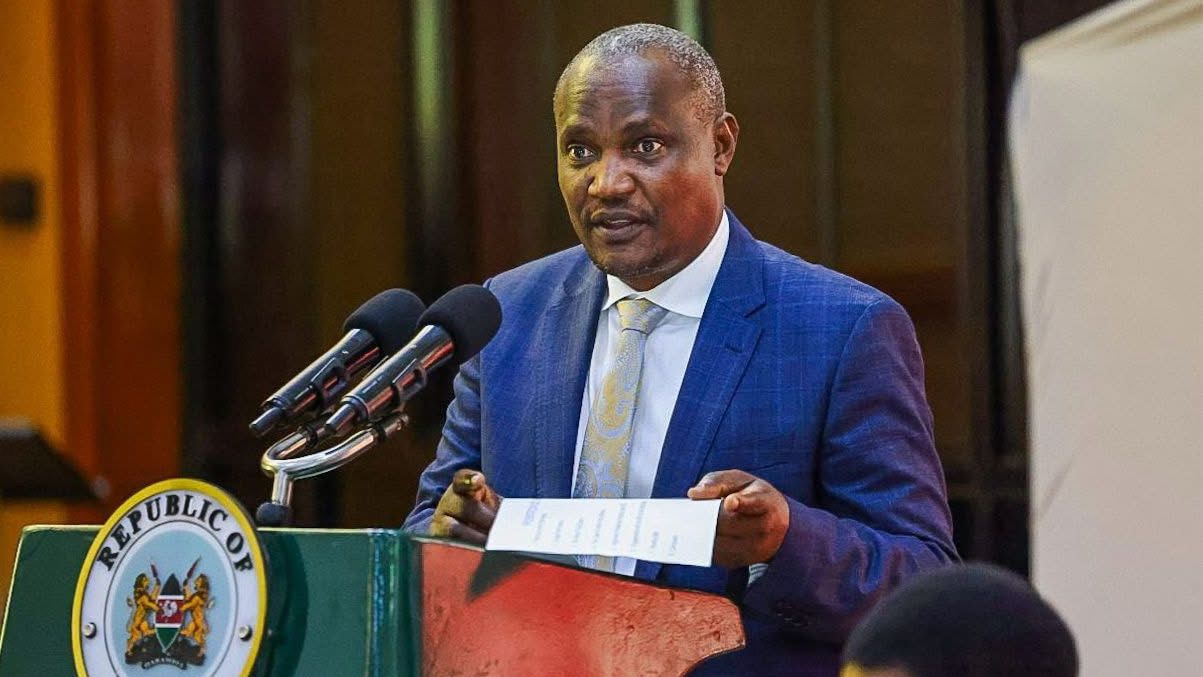

President Uhuru Kenyatta Unveils EquityBCDC

In addition, Mr Mukeba said that EquityBCDC has the capabilities to contribute significantly to the integration of the Democratic Republic of Congo into the East Africa region in terms of flow of capital and facilitation of regional trade. The bank’s business model will champion financial inclusion in DRC by empowering citizens to play an active role in the economic transformation of the country with a special focus on the corporate sector and its value chains which constitutes of the Micro, Small and Medium Enterprises (MSMEs), agriculture, artisan mining and social impact investments in education, and health,” he added.

EquityBCDC will replicate the bank Group’s business model of democratizing access to banking services and leapfrog on technology led digitization to bring affordability and convenience into the banking industry in the country. With its advanced banking security systems, the bank will enhance the ranking and rating of the financial system in the DRC making the country a competitive investment destination and a global economic player.

“The quality of Equity Group shareholding structures with global partners like International Finance Corporation and European Investment Bank strengthens Equity's place as an international bank, enabling us to offer the best to our clients”, concluded Dr. Mwangi.

-1771737995.png)

-1772447580.jpg)