President William Ruto's administration has admitted failing to achieve the desired results after entering into an oil importation deal with three Gulf-based companies.

In a report published by the International Monetary Fund (IMF), the National Treasury indicated that Kenya intends to end the deal by the end of this year after it failed to stabilise the Kenyan shilling against the dollar.

"The government intends to exit the oil import arrangement, as we are cognizant of the distortions it has created in the FX market, the accompanying increase in rollover risk of the private sector financing facilities supporting it and remain committed to private market solutions in the energy market," IMF report read in part.

The Treasury told IMF that the Government to Government (G2G) deal with Saudi Arabia which was struck by President William Ruto in April 2023, and was billed as the solution to stabilising the shilling against the dollar.

An extension was also secured which runs to December 2024, but the market has not eased, the Treasury told IMF.

Read More

"The new arrangement, based on a master framework agreed between Kenya and three national oil exporters from the Gulf, provides for six-month credit for oil imports, backed by letters of credit issued by participating commercial banks," the report read in part.

"In the first 6 months, the actual average monthly import volumes fell short of the monthly minimums agreed under the arrangement. This was due to lower demand from our domestic market as well as from the regional reexports markets. The initial agreement was extended for another twelve months to December 2024 with more favorable costing terms."

It added, "The extension of the arrangement reduces the risk of materialization of contingent liabilities due to shortfall in the actual imports."

However, the Kenyan shilling has not stabilised despite securing a contract extension.

Following the plans to exit the deal, the Treasury revealed plans to amend the country's fuel pricing formula to address the foreign exchange nightmare.

"We will also amend regulations on the fuel pricing formula to specify passthrough of the exchange rate risk component and any other risks that may materialize," the document indicated.

Kenya entered the deal with Saudi Aramco, Abu Dhabi National Oil Company and Emirates National Oil Company switching from an open tender system in which local companies bid to import oil every month.

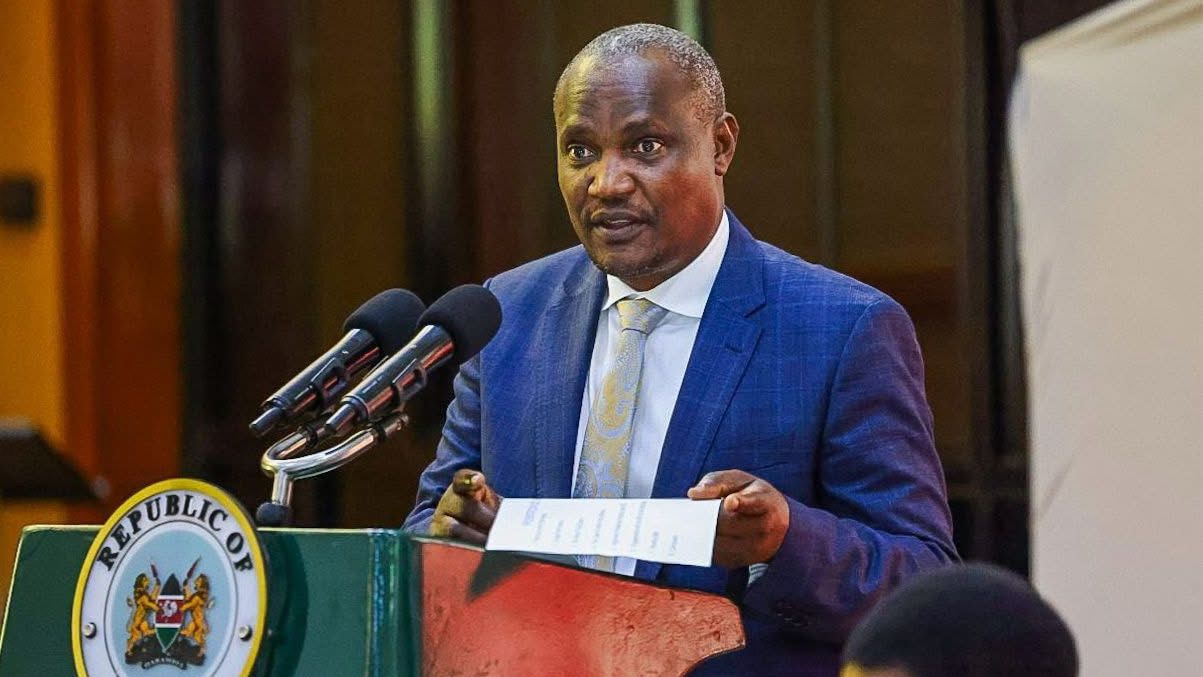

President Ruto capitalised on the deal to bring the exchange rate down.

"In the next one month or so, you will see the exchange rate coming down in a very phenomenal way, it will come down to below Ksh.120..." he said on April 11, 2023.

The Kenyan shilling has however remained under sustained pressure from the dollar, defying an April prediction by President Ruto that it would strengthen significantly.

Following the sustained pressure on the Kenyan shilling and hike in fuel prices, Opposition Leader Raila Odinga then called out the government insisting that the deal was only benefiting a few individuals.

"When Ruto initiated this deal, the US-dollar to Kenya-shilling exchange rate was Ksh132. Today, six months later, it is Ksh159 to the dollar," he added.

"The cost of fuel shot up significantly after the deal. Why have things moved from bad to worse since the deal?"

Ruto dismissed the claims insisting that the deal was transparently brokered.

-1771737995.png)