The National Assembly’s Finance and Planning Committee has rejected the Finance Bill 2025 proposal to allow the Kenya Revenue Authority (KRA) to integrate its systems with banks.

In a report tabled in the National Assembly by Molo MP Kuria Kimani, the Finance and Planning Committee said the proposal does not meet the constitutional threshold, which guarantees every Kenyan the right to privacy.

“On the proposal to grant the Kenya Revenue Authority (KRA) unrestricted access to personal data, the Committee previously deliberated and concluded that such a provision does not meet the constitutional threshold set under Article 31(c) and (d) of the Constitution of Kenya, which guarantees every individual the right to privacy.

“In its analysis, the Committee also referenced Section 51 of the Data Protection Act, which outlines specific conditions under which exemptions to data protection may be permitted,” the report reads in part.

The Kimani-led committee pointed out that the existing legal framework already provides enough authority to KRA to access relevant data from taxpayers.

Read More

“Moreover, the Committee noted that the existing legal framework, specifically Section 60 of the Tax Procedures Act, already provides sufficient authority for the Commissioner or an authorized officer to access relevant data, provided they obtain a judicial warrant. This ensures that tax enforcement powers are exercised within a framework of legal oversight and due process,” the report added.

The Finance Bill 2025 seeks to do away with Section 59, 1B of the Tax Procedures Act, which bars KRA from integrating its systems with those of a business.

The Finance Bill 2025 Section 52 states, 'Section 59A of the Tax Procedures Act is amended by deleting subsection (1B)."

"Section 59A of the Tax Procedures Act is amended by deleting subsection (1B)," reads the Finance Bill in part.

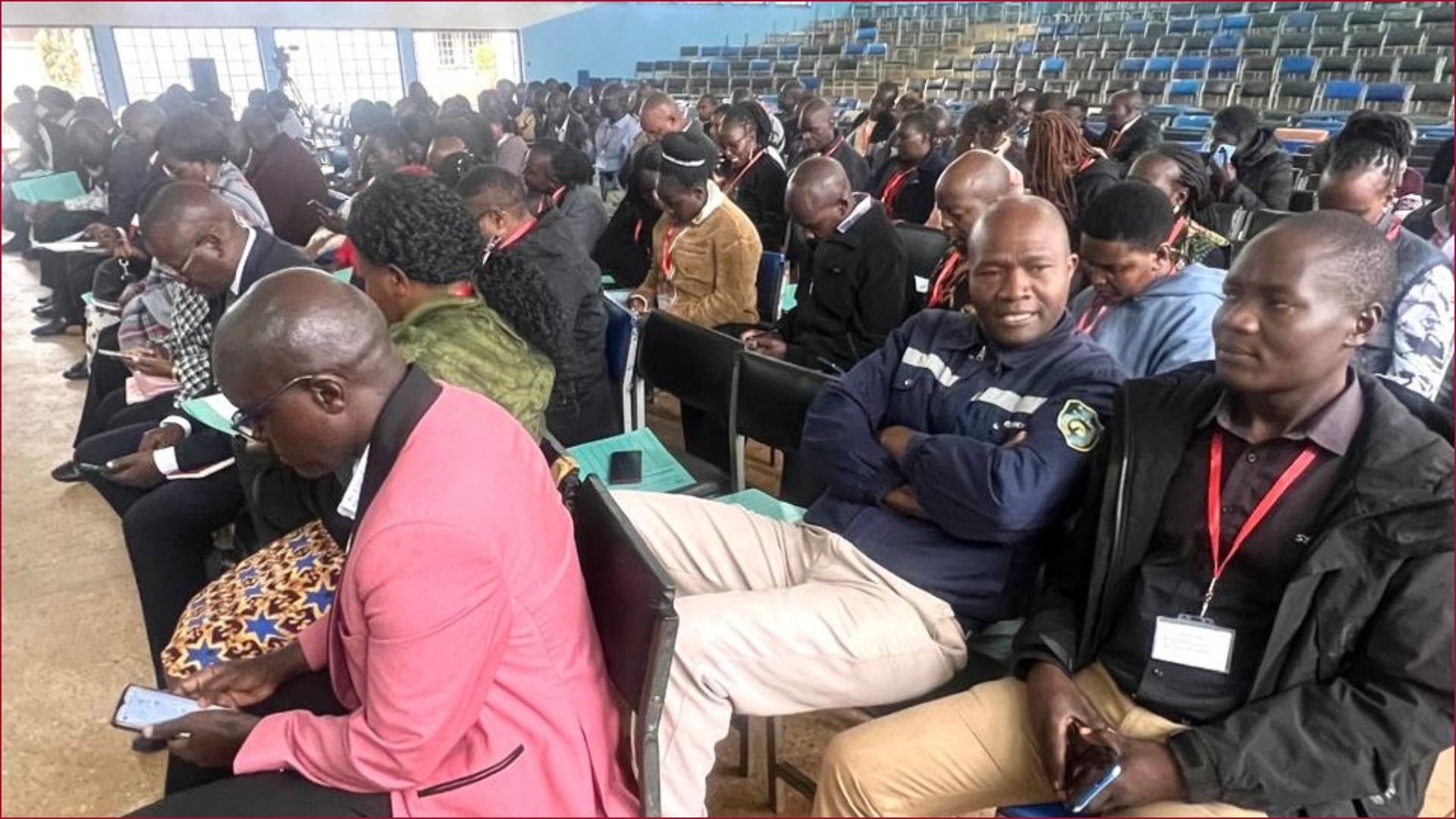

The Finance and Planning Committee’s move to reject the proposal comes days after Kimani revealed that many Kenyans during public participation expressed reservations over Finance Bill amendments that will grant KRA access to their data and that of businesses.

"One of the issues that is coming out clearly from the counties that we have visited is the issue of data privacy. Many Kenyans have come out and said that they do not think KRA, having access to their private data, is good," Kuria stated on June 6.

KRA has, on the other hand, defended the proposal, saying the move will enable them to catch up with tax cheats and Kenyans engaged in money laundering.

“If KRA wants to know whether entity A is declaring their fair share of tax, we ask them for their bank account, and then they will provide us with their bank statements. KRA will then look at the bank statements and compare them with what has been declared as their income, and if there are any variances, we always come back and ask why there are any differences,” Nickson Omondi, an official from KRA's digital tax office, explained on May 16.

-1771737995.png)