Moody’s Ratings has upgraded Kenya’s sovereign credit rating, lifting the country’s long-term local and foreign currency issuer ratings to B3 from Caa1 and revising the outlook to stable.

In a rating action announced on Wednesday, January 27, the credit ratings agency said the upgrade reflects a decline in Kenya’s near-term default risk, supported by stronger external liquidity and improved access to financing.

"Moody's Ratings (Moody's) has today upgraded the Government of Kenya's (Kenya) local and foreign currency long-term issuer ratings and foreign currency senior unsecured debt ratings to B3 from Caa1 and changed the outlook to stable from positive.

"The upgrade to B3 reflects our view that Kenya's near-term default risk has declined. External liquidity has strengthened, reflected in higher foreign-exchange reserves, a narrower current account deficit, and a more stable exchange rate. Kenya has returned to external bond markets and used the proceeds to execute liability management operations that smooth the external maturity profile and reduce near-term refinancing risks," the statement read.

Moody’s added that these developments have eased balance of payments pressures and improved funding flexibility, while better domestic financing conditions have reduced immediate reliance on external borrowing.

Read More

However, the agency cautioned that Kenya’s rating remains constrained by structural weaknesses.

"At the same time, the rating level remains constrained by weak debt affordability and limited progress on fiscal consolidation, reflecting high domestic borrowing costs and political and social constraints that hinder a durable reduction in the fiscal deficit. As a result, large fiscal deficits heighten Kenya's sensitivity to changes in financing conditions," the statement added.

Explaining the revised outlook, Moody’s said it expects Kenya to sustain recent improvements in liquidity and financing flexibility, even as fiscal challenges persist.

"The stable outlook reflects our expectation that Kenya will sustain the recent improvements in external liquidity and funding flexibility. Kenya's relatively large and diversified economy and solid medium-term growth potential provide some capacity to absorb shocks, but a long a track record of recurring revenue underperformance and weak fiscal execution constrain fiscal policy effectiveness," the statement continued.

Under its baseline scenario, Moody’s projects that Kenya’s fiscal deficit will remain elevated, with debt levels stable but affordability weak.

"Under our baseline, the fiscal deficit will remain close to 6% of GDP, with debt broadly stable at around 67% of GDP. Heavy reliance on domestic borrowing supports near-term financing capacity, but high domestic interest rates will keep the interest costs elevated and constrain already very weak debt affordability," the statement further read.

Alongside the sovereign rating upgrade, Moody’s also raised Kenya’s local and foreign currency ceilings.

The agency noted that the gap between the ceilings and the sovereign rating reflects institutional and political risks, despite limited external imbalances and lower external debt exposure.

"Concurrent with today's rating action, Kenya's local currency ceiling has been raised to Ba3 from B1, while the foreign currency ceiling has been raised to B1 from B2," the statement noted.

In its ratings rationale, Moody’s highlighted the strengthening of Kenya’s external liquidity buffers.

"Kenya's external liquidity has strengthened markedly, supporting its capacity to meet external debt-service obligations over the next several years and reducing near-term default risk. International reserves rose to $12.2 billion at year-end 2025, equivalent to 5.3 months of import coverage, up from $9.2 billion at year-end 2024," the agency explained.

Moody’s attributed the reserve buildup to stronger foreign exchange inflows and a sharply narrower current account deficit, while warning that Kenya remains exposed to exchange rate risks due to the high share of foreign currency-denominated debt.

The agency also pointed to Kenya’s renewed access to international capital markets as a key factor behind the upgrade.

"In 2025, the government completed two eurobond issuances totaling $3.0 billion and used part of the proceeds to buy back $1.2 billion of bonds maturing between 2026 and 2028. These transactions have smoothed the external maturity profile and effectively pushed the next large eurobond maturity to 2030," the statement read.

Elsewhere, on domestic financing, Moody’s noted that easing monetary conditions and strong investor demand have improved the government’s ability to fund large fiscal needs locally.

"Bond auctions have remained oversubscribed through the fiscal year ending June 30, 2026 (fiscal 2026), even as domestic issuance has increased, indicating improved market absorption capacity," it noted.

Despite these gains, Moody’s warned that Kenya’s debt affordability remains among the weakest of rated sovereigns, with interest payments consuming more than 30% of government revenue.

Moody’s said the stable outlook balances upside and downside risks.

"Stronger-than-expected economic growth or more effective delivery of fiscal consolidation, broadly in line with the government's medium-term fiscal projections, could support a faster improvement in debt affordability and financing flexibility," the statement indicated.

However, the agency warned that weaker fiscal performance or rising borrowing costs could lead to renewed pressure on the rating.

The report also highlighted environmental, social and governance risks weighing on Kenya’s credit profile, including climate-related vulnerabilities, high poverty levels, unemployment, and weak governance indicators.

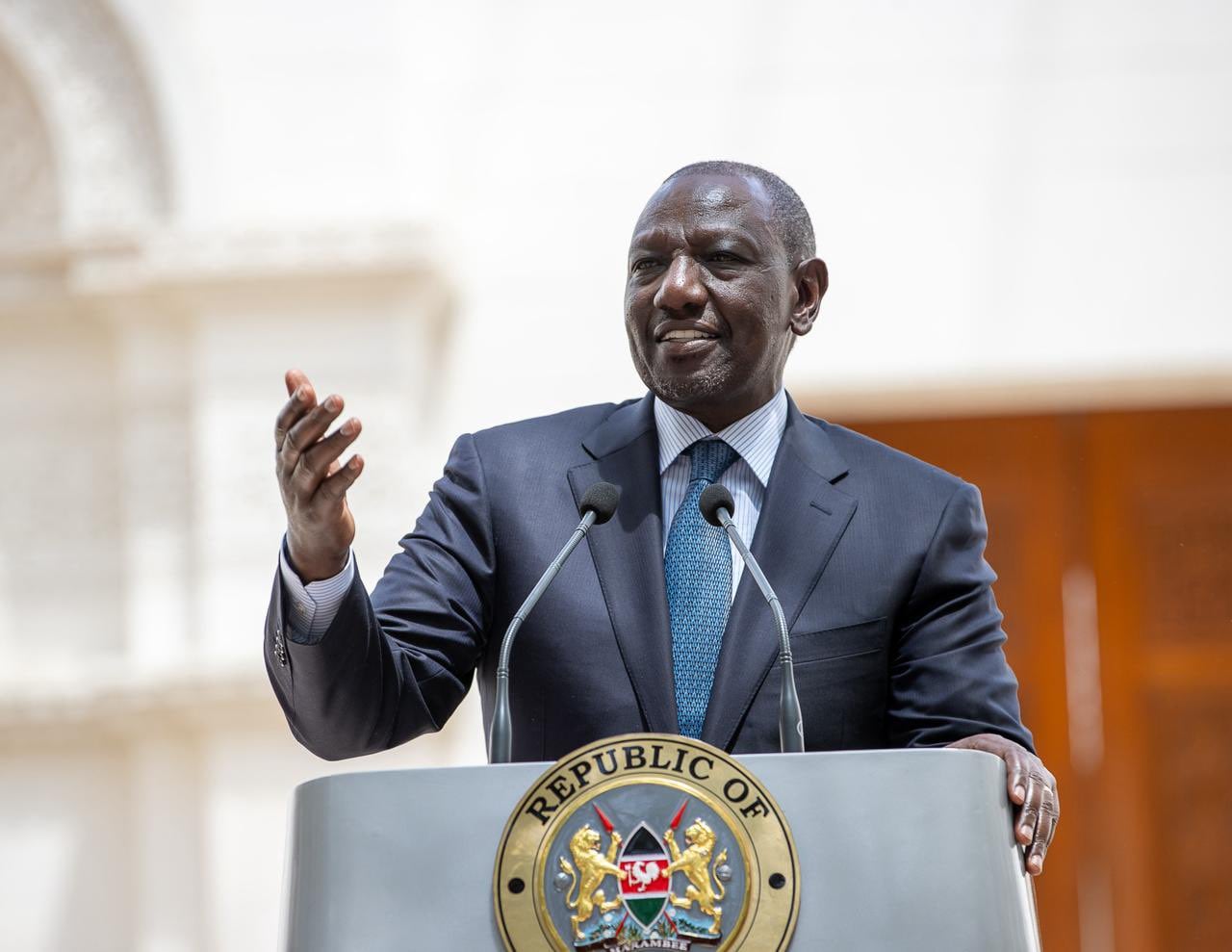

This comes a year after the agency lauded President William Ruto's management of the economy.

In their findings released on January 24, 2025, the company noted that Kenya stood a high chance of highly reducing liquidity risks and improving debt affordability.

"Domestic financing costs have started to decline amid monetary easing and could continue if the government sustains its more effective management of social demand and fiscal consolidation," the report partly read.

Moody's noted that if Ruto's administration continued the course, Kenya would increase its credit score and easily attract funding.

"Such a track record would also boost Kenya's access to concessional and commercial external funding. Revenue collection efforts, if successful, present the potential for further improvements in debt affordability, although Kenya has struggled to expand revenue significantly and durably in the past, notwithstanding recent measures," the report read on.

The institution, however, observed that Kenya's fiscal health is still not out of the woods, given the increasing needs and limited funding.

It said Kenya had a lot to do to strengthen its fiscal wellness; the high levels of poverty indicate Kenya has yet to make it.

Among the measures it recommended were strengthening the country's financial policy effectiveness, curbing corruption and improving the implementation of the rule of law.

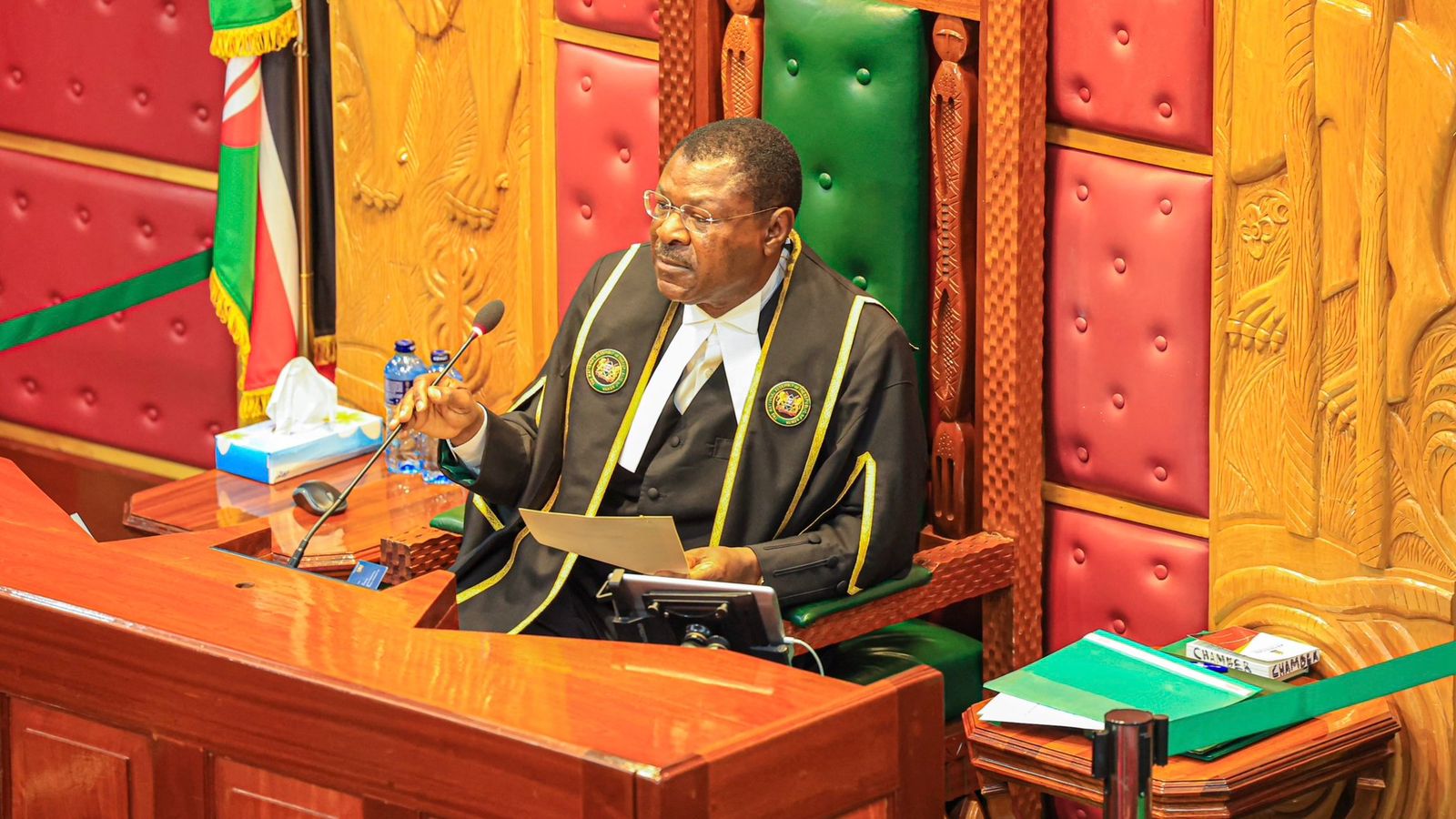

-1770784420.png)