The Kenya Revenue Authority (KRA) has extended the deadline for filing tax returns by 24 hours, following technical issues experienced on Monday, June 30.

In a statement on Monday evening, KRA said the extension would give taxpayers additional time to file and pay their returns.

The new deadline is now set for midnight on Tuesday, July 1.

“We have opened a service lane! There is a 24-hour extension up to tomorrow, 1st July 2025, midnight to file and pay your returns,” KRA said in the statement.

The move comes after numerous taxpayers reported being unable to access the iTax portal for several hours on Monday, as the system struggled with overwhelming traffic on the final day of filing.

Read More

To facilitate the extended period, KRA announced extended operating hours at its service centres and contact centre.

“On Tuesday 1st July 2025, our Contact Centre will be open from 7:00 AM to 8:00 PM, while all our Tax Service Offices will remain open from 8:00 AM to 8:00 PM,” the authority said.

KRA is urging taxpayers to take advantage of the extension and avoid last-minute congestion.

In a statement dated Friday, June 13, KRA announced that all Kenyans with a KRA pin were required to file their returns for 2024.

Therefore, those who did not make any income in 2024 were encouraged to file their returns on eCitizen, as it only takes a few minutes.

This can be done on eCitizen through the steps below;

- One should log into their eCitizen account and pick the KRA services.

- Alternatively, visit the KRA services through the link - https://ecitizen.kra.go.ke.

- Once on the KRA services tab, sign in using your KRA PIN and login details. In some cases, the system will be integrated with your account; hence, login will be automatic.

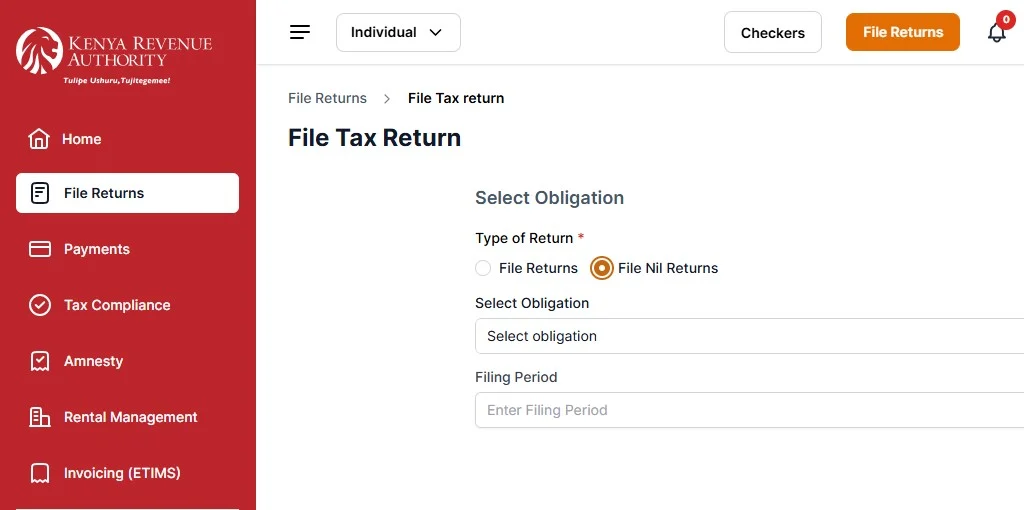

- Once logged in, select the 'File Returns' tab that is next to your profile.

- Select the 'File Nil Returns'.

- Select Obligation - Individual Income Tax.

- Enter the obligation period (1/1/2024-31/1/2024) - This will automatically be filled.

- After confirming the details, click on the Next tab to complete the filing of returns.

Alternatively, nil returns can be filed on the iTax platform through the following steps;

- Visit KRA's iTax portal - https://itax.kra.go.ke/KRA-Portal/.

- Log in to your portal using the provided credentials.

- Navigate to the Return Menu and select 'File Nil Returns'.

- Choose the correct tax obligation and fill out the Nil e-Return form, indicating the return period.

- Confirm submission of nil return.

- Download the nil return receipt.

-1773143005.jpg)