Seven senior officials and former executives of Invesco Assurance Company Limited and Compliant Insurance Agency have been charged with orchestrating a fraud scheme involving Ksh309 million in client premiums.

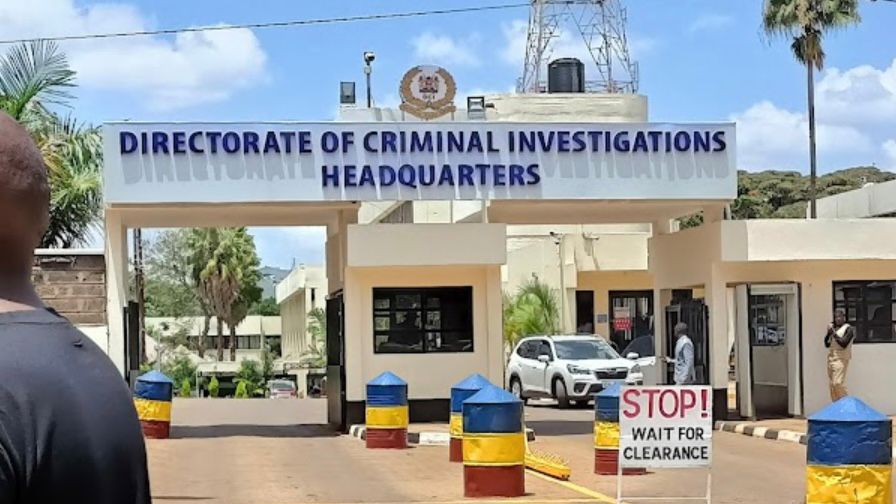

In a statement on Wednesday, May 21, the Directorate of Criminal Investigations (DCI) said the accused were arraigned at the Chief Magistrate's Court in Milimani following months of intense investigations

The seven include Albert Karakacha Muhavani, former Director, Invesco Assurance Company Limited; Daniel Wekesa Nyalyanya, former Chief Finance Officer, Invesco Assurance Company Limited; Michael Ngángá Kibara, former Accountant, Invesco Assurance Company Limited, and Ruth Wangari Mwasalu, director, Compliant Insurance Agency.

Others are Antony Githinji Ngerere, director, Compliant Insurance Agency; Hildah Wambui Karanja, director, Compliant Insurance Agency, and Lameck Gisore Ongere, director, Compliant Insurance Agency.

"Their arrest and subsequent arraignment followed meticulous investigations conducted by DCI's Insurance Fraud Investigation Unit, which commenced on September, 2024 when officials at the Insurance Regulatory Authority discovered a broad fraudulent scheme implicating them," the statement read.

Read More

According to the DCI, the investigations began after officials at the Insurance Regulatory Authority flagged suspicious transactions involving Invesco Assurance.

The Policyholders Compensation Fund (PCF), while taking over the company’s assets under statutory management, discovered the existence of a secret bank account.

It was established that all insurance premiums collected from 27 Invesco branches across the country were channeled into the secret account.

"Through a letter to the investigators by Policyholders Compensation Fund (PCF), ARA stated that in the course of taking over assets of Invesco Assurance Company Limited (under statutory management), they uncovered that the insurer was using a secret bank account registered in the name of Compliant Insurance Agency domiciled at M Oriental Bank (Sameer Business Park Branch) opened on 1st May, 2024, with signatories to the said account being top management of Invesco Assurance Company Limited.

"All the collections of insurance premiums from 27 branches across the country were being remitted into the said bank account," the statement added

According to DCI, between May 1st and August 15th 2024, a total of Ksh309 million was withdrawn and transferred through personal Mpesa accounts of the accused.

"Investigations commenced, and statements were recorded from relevant witnesses and all relevant documents collected. The evidence pieced together revealed that the then top management of Invesco Assurance Company Limited (Directors, Chief Finance Officer and an Accountant), between 1st May, 2024 and 15th August, 2024, siphoned a total of Ksh 309 million through their respective Mpesa accounts from the said account," the statement further read.

After reviewing the investigation file, the Office of the Director of Public Prosecutions (ODPP) recommended several charges including insurance fraud.

"A case file accompanied by all the evidence was forwarded to the Office of the Director of Public Prosecution (ODPP), who on perusal advised that the seven be charged with the offence of Insurance Fraud Contrary to Section 204B(2) as read with Section 204B(5) of the Insurance Act.

"Additionally, accused number four (4) to seven (7) were to face another charge of Stealing by Directors contrary to Section 282 of the Penal Code," the DCI stated.

All seven suspects were arrested on Tuesday, May 20, and held at Capitol Hill Police Station ahead of their arraignment.