President William Ruto has disclosed that 90 percent of Kenyans are repaying the Hustler Fund loans.

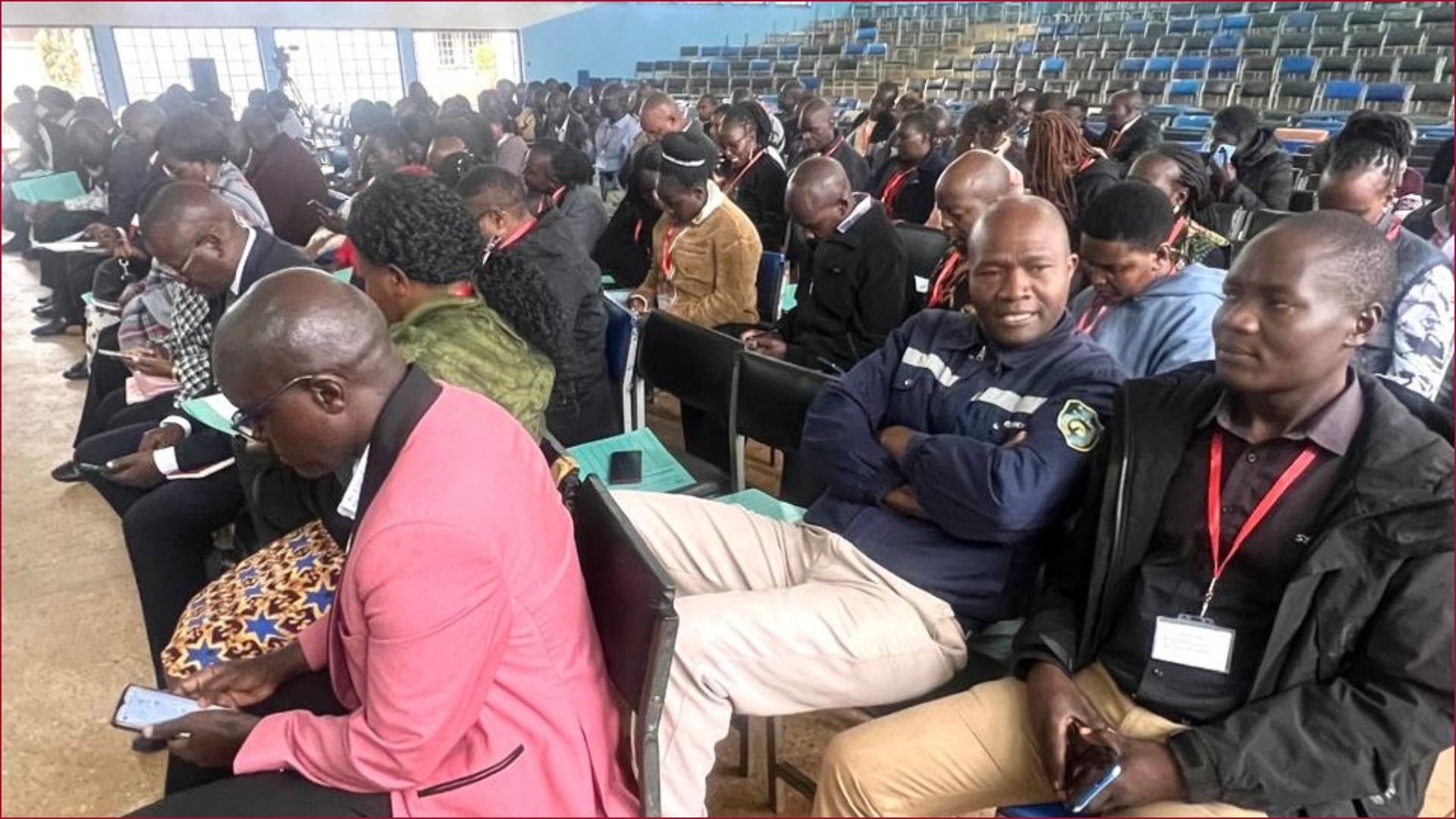

Speaking on Wednesday, April 9, during the opening of the World Chambers Federation (WCF) Africa Summit 2025 at KICC Nairobi, the President said Kenyans are willing to repay their loans despite the Hustler Fund having no collateral.

Ruto noted that Kenyans are repaying their Hustler Fund debts because they see the value they get in the product.

“It is amazing how the Hustler Fund today, despite having no collateral, up to 90 per cent repayment is happening.

“You would expect that a financial product that has no collateral and therefore individuals would have no incentive to pay back, but they are paying back because they see the value of the low interest they get in that product and that is why repayment is all the way up to 90 per cent,” said President Ruto.

Read More

The Head of State also said the Hustler Fund has already unlocked access to affordable credit for millions of Kenyans.

“Our goal is to catalyse a bottom-up surge of creative and productive opportunities through strategic investment and targeted intervention. The Financial Inclusion Fund or ‘Hustler’ Fund, for example, which was launched in 2022, has already unlocked access to affordable credit for millions of Kenyans,” Ruto added.

President Ruto launched the Fund in November 2022 in a move to support Kenyans with products that are responsive to their enterprises.

The loan product, which is accessible through USSD and mobile APP platforms, enables borrowers to access up to Sh50,000 at an annual rate of eight per cent.