Millions of Kenyans own bank accounts and make deposits or receive salaries for those who've been employed. Banks are considered safe spots for storing money. However, do you know that banks can collapse with your deposits? If so, what happens in that case?

KDIC Mandate and Functions

That is where the Kenya Deposit Insurance Corporation (KDIC) comes in. KDIC is a state agency established under the Act of Parliament, KDI Act Cap. 487C, whose mandate is to provide deposit Insurance for member institutions (banks), Liquidate, and Wind up troubled banks.

In fulfilling its mandate, KDIC protects depositors against the loss of all their deposits or bank balances in the unlikely event of a bank failure by providing payments of insured deposits. This is important as it helps enhance depositors' confidence, in that customers get the reassurance that their money is safe and they can still get it back even in the unfortunate event that a bank goes under.

When talking to Kenyans, a good number will tell you they don't save money in financial institutions because they fear losing it. Still, this reassurance enhances confidence while inspiring a saving culture.

Read More

In addition to providing deposit insurance, the corporation also provides incentives for sound risk management and promptly resolves problem banks to mitigate any failure proactively.

Brief History of KDIC and Member Institutions

KDIC Was Founded in 1985 as the Deposit Protection Fund Board (DPFB). It officially started operating on 1 September 1986 and received its first case on 31 January 1993, in which it was required to pay off protected depositors and undertake a liquidation process.

Since then, it has evolved from DPFB into KDIC and grown in membership. According to the KDI Act Cap.487C, KDIC membership is compulsory and comprises all institutions licensed as deposit-taking institutions and regulated by the Central Bank of Kenya.

As of October 2024, KDIC membership stood at thirty-seven (37) commercial banks, one (1) mortgage institution, and fourteen (14) microfinance banks.

Bank Crises in Kenya

KDIC was established in response to challenges presented by banking crises and has operated for over thirty years. Before and after its establishment, the country has experienced several bank crises. Below is a breakdown of some of the instances:

Crises in 80s

The first banking failure in Kenya was recorded in 1984 when two locally owned institutions collapsed and were liquidated by the official receiver. Unfortunately, depositors were not compensated, and as such, they lost their money, and the public lost confidence in financial institutions.

In 1989, the country faced its second banking setback, where nine financial institutions suffered liquidity strains, leading to a systemic crisis. The nine financial institutions were Jimba Credit Corporation Limited, Union Bank of Kenya Limited, Kenya Savings and Mortgages Limited, Estate Finance Company of Kenya Limited, Estate Building Society, Business Finance Company Limited, Citizen Building Society, Nationwide Finance Company Limited, and Home Savings and Mortgages Limited.

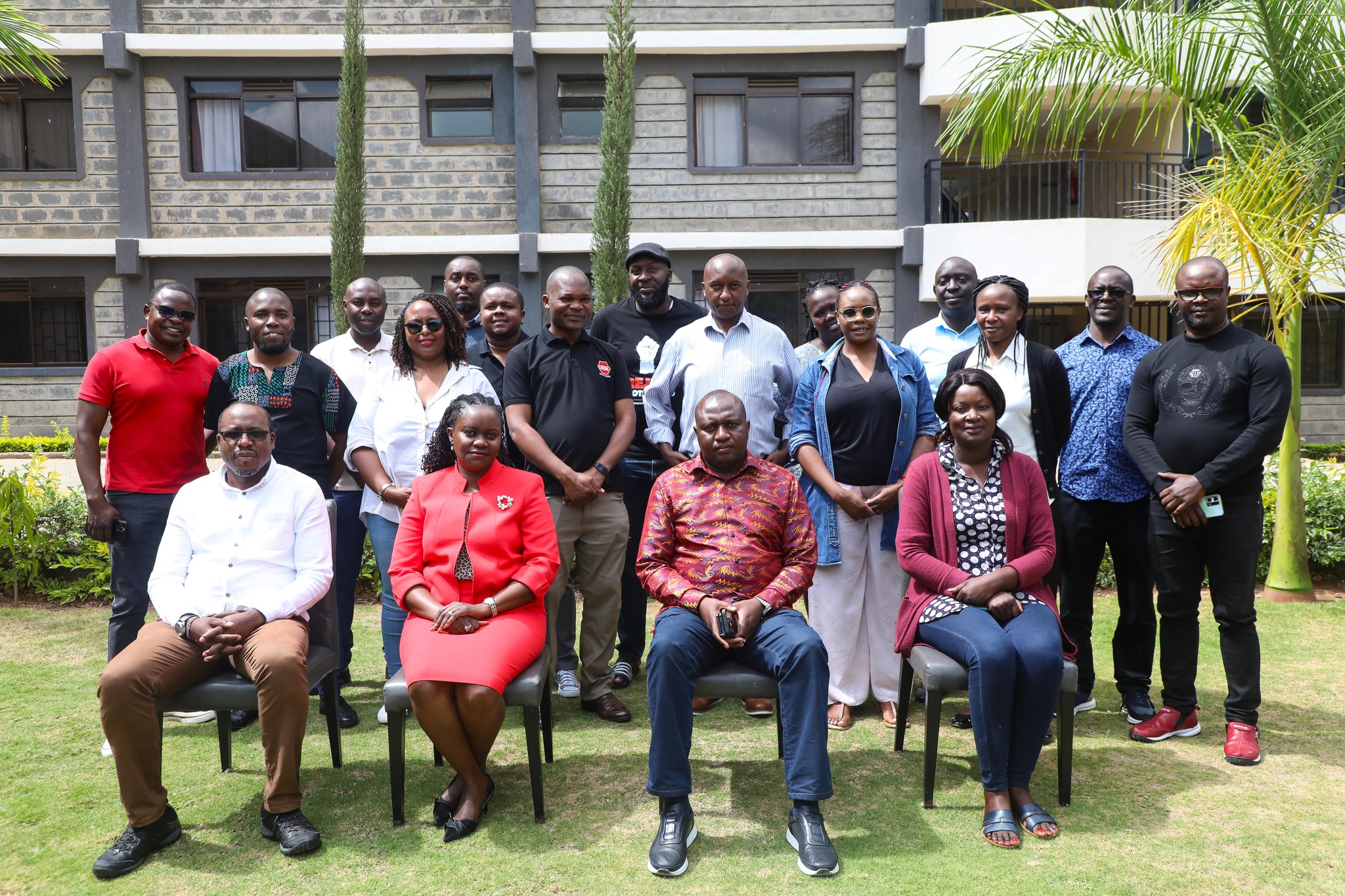

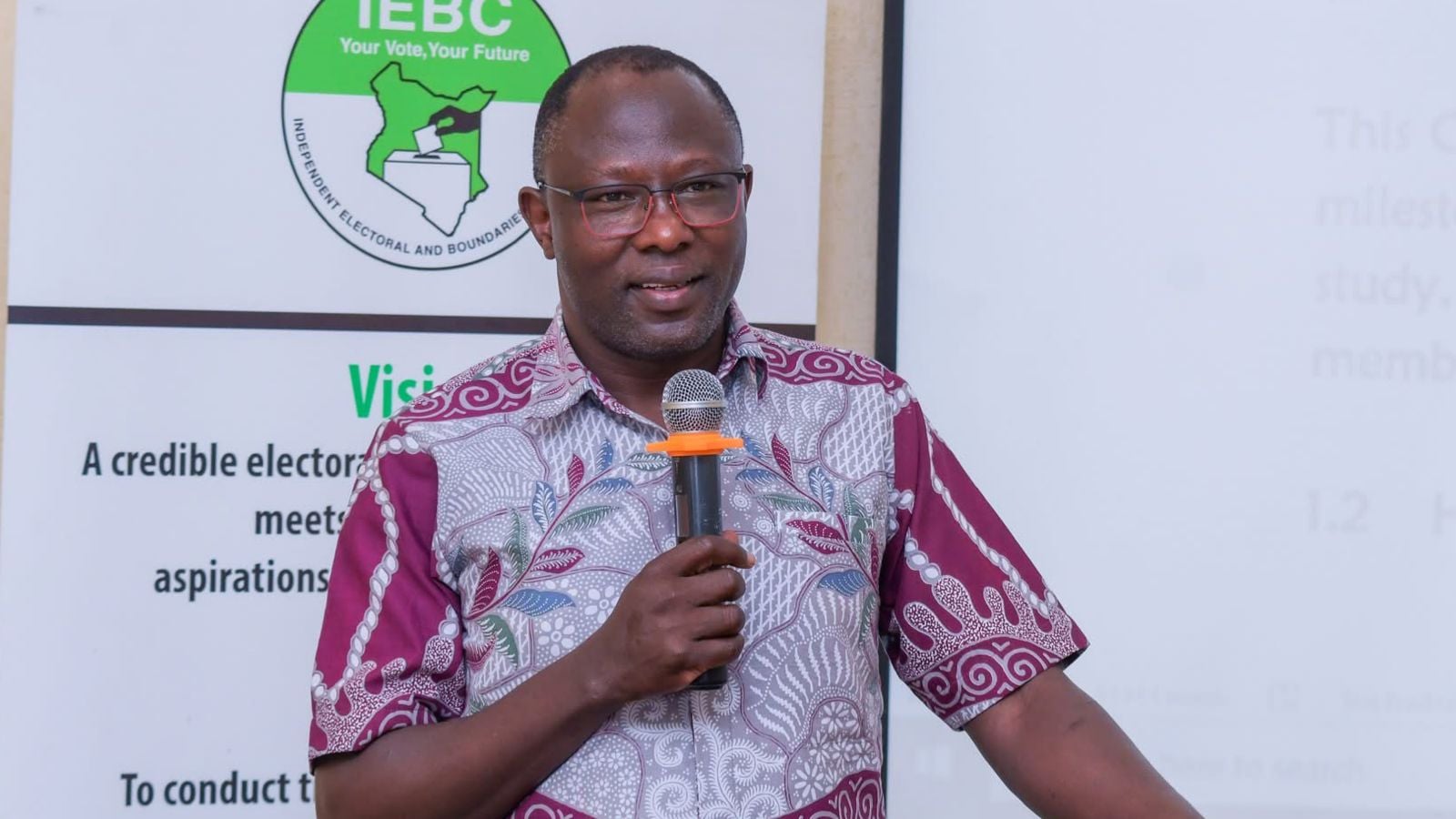

The Kenya Deposit Insurance Corporation partners with the Media Council of Kenya to sensitise Business editors on the mandate of KDIC as well as discuss the media's role in breaking down complex financial regulations to the public. .@KDICkenya pic.twitter.com/PZVISYeJl0

— NairobiLeo.co.ke (@Nairobi_Leo) October 11, 2024

Crises in the 90s

In the 1990s, the country faced another series of bank crises. For instance, between 1993 and 1996, the Export Bank, Trade Bank, Pan-African Bank, and several other financial institutions collapsed. The collapse was credited to insider dealings and a loss of public confidence that resulted in panic runs on bank deposits.

In 1998, a liquidity crisis led to the collapse of five banks: Reliance Bank, Bullion Bank, Prudential Bank, City Finance, and Trust Bank.

Crises in 2000s

In 2000, Delphis Bank Ltd. experienced challenges that led to its collapse. It was restructured and currently operates as M-Oriental Bank Limited.

In 2003, the country recorded the collapse of Eurobank Ltd and Daima Bank Ltd. Three years later (2006), Charterhouse Bank Limited was placed under statutory management.

The most recent crises are those of Imperial Bank, Chase Bank, and Dubai Bank Ltd, which occurred between 2015 and 2016. The first two institutions were placed under receivership, while the latter was placed in liquidation.

How does Deposit Insurance Work?

The crises have shown that deposit insurance is important because a lack of it means depositors will lose money in the unfortunate event that a bank collapses, as witnessed in 1984. The insurance covers all types of deposit accounts. However, it is important to note that protected payment is restricted to one depositor per institution.

If a depositor has more than one account in an institution, the accounts are consolidated for settlement as one claim subject to the maximum protected limit of Ksh.500,000.

The limit was set after analyzing the institutions' returns. It provides full deposit insurance coverage for over 99% of deposit accounts in the country.

For joint accounts, KDCI Considers the joint account separate from each account. Given the above, the aggregate amount of insured deposits is insured up to Ksh.500,000 because each joint account holder is assumed to have an equal share in the joint account.

KDIC makes deposit insurance payouts when a court of law has directed it or when an institution has been placed in liquidation by the Central Bank of Kenya and an appointed liquidator.

What has KDIC Achieved so far?

One of KDCI's main achievements is increasing the coverage limit from Ksh 100,000 to Ksh 500,000. This is huge as it ensures depositors get an increased refund in the unfortunate event that a bank where they've deposited their cash collapses.

Other achievements by the agency are;

- Introduced Risk-Based Premium to provide incentives for sound risk management.

- It enhanced collaborations & partnerships with member banks. It was conducting activities together.

- It has enhanced public awareness. KDIC has continued to invest in sensitizing the public on deposit insurance.

- Collaborations with key stakeholders (media, CBK, other financial sector regulators, etc.) are needed.

- Knowledge sharing: KDIC is a regional leader in helping other DIs on matters of Deposit Insurance